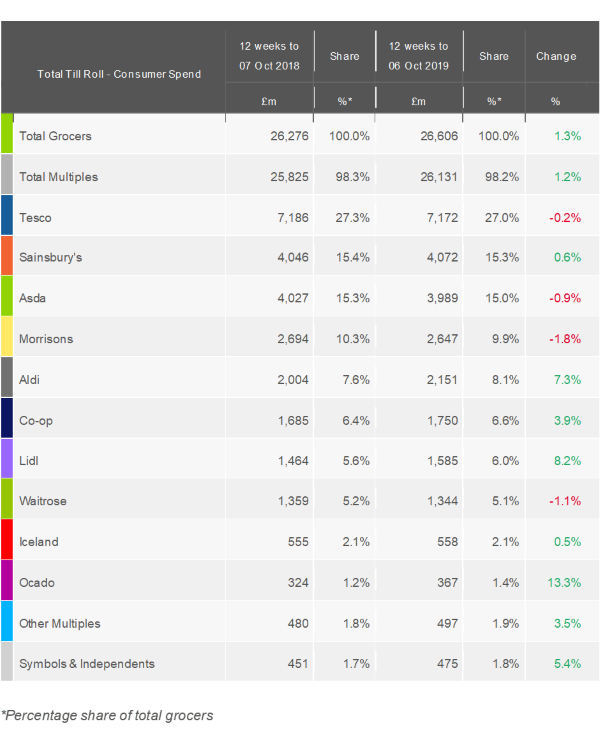

Latest grocery market share figures from Kantar show total supermarket sales grew by 1.3% year-on-year over the 12 weeks to 6 October with Sainsbury’s continuing its recent run of better performance following investment in cutting prices and improving its offer.

The data suggests that the grocery market is finally edging out from under the shadow of 2018 and tough comparisons with the strong summer sales of last year. This supported Sainsbury’s sales increase of 0.6% – its fastest rate of growth since October 2018.

Fraser McKevitt, head of retail and consumer insight at Kantar, said: “The grocer recently announced plans to phase out its value ‘Basics’ line which made it into 12% of shopping baskets during the past 12 weeks, so it will be interesting to see how replacement brands like ‘Stamford Street’ and ‘J. James & Family’ fare as they become more widely available.”

The performances of Tesco, Asda and Morrisons all improved compared with last month, but their sales still fell year-on-year in the face of ever increasing competition from the discounters.

Tesco’s sales edged down 0.2% and its market share slipped to 27.0%. McKevitt commented: “The announcement that Dave Lewis will depart as Tesco chief executive next year has inspired inevitable reflection on his tenure and it’s worth noting that the retailer’s sales were in freefall when he joined in September 2014 – dropping 4.5% year on year. Since then Tesco’s absolute and relative performance has improved and profitability has returned, but its market share is down from 28.8% at the start of his time there.”

Sales at Asda fell by 0.9% during the period, dropping 0.3 percentage points of market share to 15.0%. Meanwhile, Morrisons continued its recent poor run with its sales declining by 1.8% and market share slipping to 9.9%.

Lidl and Aldi continue to gain share with the two discounters now accounting for a combined 14% of UK grocery sales. This is 0.8% percentage points higher than last year, an increase that’s worth nearly £1bn annually.

Whilst traditionally known for its own label ranges, Kantar highlighted that Lidl’s 8.2% growth was boosted by sales of branded goods which grew twice as quickly.

Aldi’s sales rose by 7.3% as it attracted more new customers than any other retailer with 689,000 additional shoppers. The chain’s small but growing ‘Everyday Essentials’ range also added an extra £18m in sales.

The Co-op grew at its fastest rate since April at 3.9% as the convenience retailer’s £5 ‘Super saver deal’ drove up sales of fresh pizza by 20% and ice cream by 17%.

With consumers cautious in their spending due to worries about the impact of a no-deal Brexit, Kantar found that proportion of sales on promotion in the grocery sector increased for the first time in nearly four and a half years to 32.3%, driven by Tesco’s ‘100 years of value’ campaign and Sainsbury’s ‘Price Lockdown’.

However, Kantar found that despite well-documented concerns about the availability of popular products in the event of the UK crashing out of the EU, this has not yet translated into a consistent increase in purchasing. Sales of dry pasta and healthcare products over the past four weeks were 9% and 7% higher than the same time last year, but those of canned products fell by 2% and frozen food by 1%.

McKevitt commented: “While a quarter of British consumers say they are considering stockpiling, it seems they are waiting to see how the next few weeks play out and we expect if they take any action it will be closer to the deadline if a chaotic trading situation looks increasingly likely.”

NAM Implications:

- The big idea still appears to be the need for suppliers to find ways of participating in discounter growth, the only show in town…

- …except Amazon…

- Especially as brands appear to be outselling own label (in Lidl)…