Latest data from Kantar shows the UK dairy market has seen a slight improvement in growth, driven by key product areas.

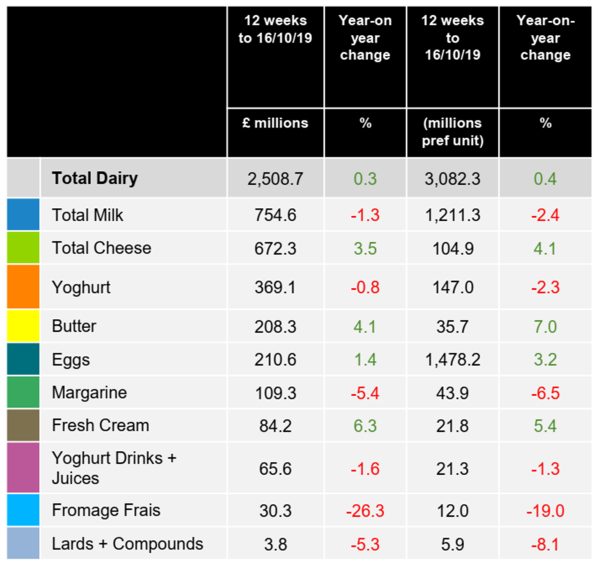

In the 12-week period to 16 October, the market grew 0.4% compared with 0.2% seen over the previous 12 weeks. During the same period, the wider grocery market grew 1.3%, while the fresh and chilled sector accelerated its growth to 1.1%, up from 0.5%.

Nearly half of the sectors in dairy are contributing to the positive performance in the market, with butter, cheese and cream leading the way. On the other hand, the contribution to decline in milk worsened to the tune of £3.6m.

Kantar found that most retailers improved their contribution to dairy growth with only Sainsbury’s, Waitrose and Aldi making a negative contribution. Sainsbury’s and Waitrose fared the worst, with their contribution declining by £4.1m and £1.6m respectively. Interestingly, Aldi’s growth slows for the fourth period in a row.

The sectors driving the contribution to decline in Sainsbury’s are yoghurt (-£1.4m vs last period), eggs (-£1.2m) and milk (£-1m). Cheese contributes to overall market growth, with sales up 3.5%, driven by Morrisons, the Co-op and Iceland.

The trend of contribution from shoppers in the lower socio-economic (C2DE) groups decreasing continued this period but it did slow, resulting in a positive change in contribution of £2.8m Shoppers across most life stages saw positive change in contribution with pre-family seeing the biggest change and reducing their decline by £3.3m. Kantar stated that the strong performance of cheese was driven by contribution growth in upmarket (AB) shoppers (£2.3m) and retirees (£1.9m), a steady trend seen across the last four 12 week periods.

The growth in dairy overall came mainly through full price sales (£6.4m) and an uptick in Y for £X promotions (£6.9m), despite the latter’s decline period on period. Price reductions had been pulled back resulting in -£11m less vs the previous 12 weeks. Cheese grew predominantly through base sales (£3.3m) but also Y for £X promotions (£1.2m).