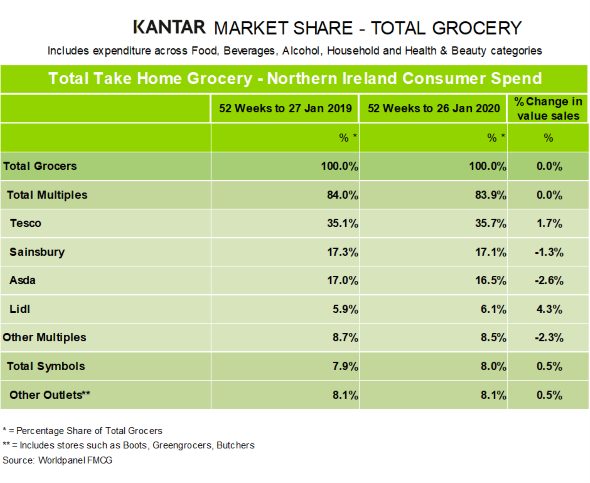

The Northern Irish grocery market was unchanged during the 52 weeks to 26 January 2020 as overall growth stood at 0.0%.

The data from Kantar showed volume sales have continued to decline and are now down 0.6% year-on-year. More frequent trips by shoppers and an average price rise of one pence per item failed to outweigh the impact of falling basket sizes, which dropped by 3.6%.

Commenting on individual retailer performances, Matthew Botham, strategic insight director at Kantar said: “Sales at Asda and Sainsbury’s decreased this month by 2.6% and 1.3% respectively. Although basket sizes have continued to grow at Asda – bucking the market trend to rise by 2.2% – the retailer has seen fewer shoppers coming through its doors. Meanwhile, at Sainsbury’s, increases in shopper frequency, by 3.1%, and pack price, by 0.4%, were not enough to outweigh falling shopper numbers and basket sizes.

“Overall, Lidl was the best performing retailer. Northern Ireland’s fastest-growing grocer gained 0.2 percentage points this period, increasing its market share to 6.1%. Though basket sizes fell into decline in line with the wider market, this was eclipsed by shoppers visiting the retailer more often. Growth was also driven by a rise in pack prices, suggesting that shoppers were choosing more premium options in store.

“Tesco enjoyed the greatest increase in market share, up by 0.6 percentage points to 35.7% – the retailer’s highest share for over four years. Tesco customers made an average of six more trips to the retailer this year, counteracting falling basket sizes.”

Separate data released by Kantar yesterday for the Republic of Ireland showed that growth in the grocery market had slowed to 1.3%, the weakest rate recorded since March 2017, after shoppers tightened their purse strings ahead of the country’s General Election.