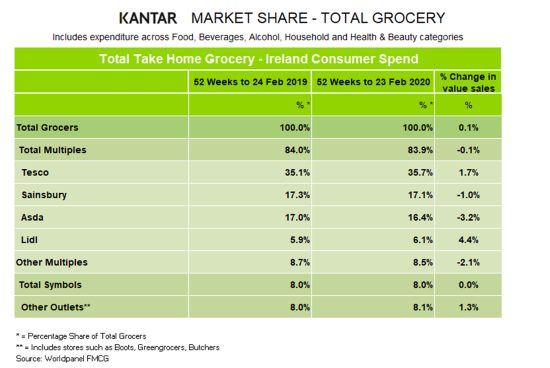

The Northern Irish grocery market returned to modest growth during the 52 weeks to 23 February 2020 as total value sales grew by 0.1%.

The data from Kantar also shows the volume sales decline slowed this period, now down 0.4% year-on-year compared with 0.6% previously. More frequent trips by shoppers and an average price rise of one pence per item eclipsed falling basket sizes, which dropped by 2.8%.

Commenting on individual retailer performances, Charlotte Scott, consumer insight director at Kantar, said: “Overall, Lidl was the best performing retailer – increasing its value sales by 4.4%. The discounter gained 0.2 percentage points this period, taking its market share to 6.1%. Though shopper numbers fell by 1.6%, this was outweighed by people visiting the retailer more often. Growth was also driven by a rise in pack prices, up 3.4%, suggesting that shoppers were trading up in store and choosing more premium options.

“Tesco, Northern Ireland’s largest retailer, enjoyed the greatest increase in market share, up by 0.6 percentage points to 35.7% with sales growth of 1.7%. Tesco customers stepped up the frequency of trips made to the supermarket in this period, which offset a drop in basket sizes by an average of one item per trip.

“Sales at Asda and Sainsbury’s decreased this month by 3.2% and 1.0% respectively. At Sainsbury’s, an increase in shopper frequency – up by 2.9% – was not enough to counteract falling pack prices, shopper numbers and basket sizes. While basket sizes have continued to grow at Asda – bucking the market trend to rise by 2.6% – the retailer has seen fewer shoppers coming through its doors and less often.”

NAM Implications:

- We can never forget Tesco…

- …but surely Lidl deserves a bigger role in our trade strategies?