Amongst the winners and losers to have emerged as a consequence of the coronavirus lockdown, the Spirits category has definitely fallen into the ‘Winners’ camp in the convenience sector. The Rate-of-Sale (RoS) in the past few weeks is running 53% higher than at the start of 2020, according to analysis by The Retail Data Partnership.

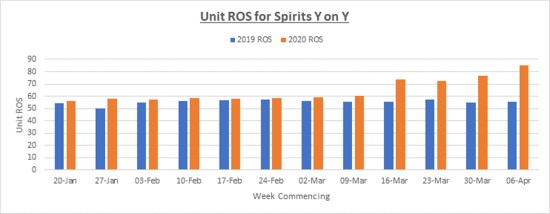

The sector is used to a fall in RoS early in the year for Spirits products that fly off the shelf over Christmas, with a gradual recovery occurring in February and March. The data shows that this same pattern occurred in the first 11 weeks of 2020. However, since the 9 March, there has been a substantial surge with latest figures giving no indication of any slowdown. This is good news for Spirits suppliers, which have obviously seen their sales hit hard in the on-trade following the lockdown.

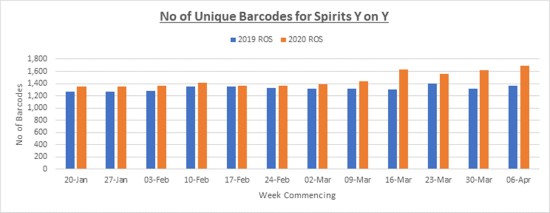

The Retail Data Partnership highlighted that another unexpected change in buying habits in recent weeks has been a dramatic increase in the range of Spirits being sold – up by 34%. The EPOS systems firm said it was unclear why this was happening but suggested it could be that retailers have not been able to source their normal range of products, so have bought whatever is available from wholesalers. It may also be that retailers have responded to requests from their customers to source products that they would normally drink in pubs.

So, in spite of the gloom which has been published about the prospects for Spirits suppliers, there is at least a convenience-sector-related silver lining to the cloud of the coronavirus outbreak.

Stephen Burnett, MD of The Retail Data Partnership, said: “This is another example of how analysts of the overall market can get things drastically wrong. Many of them base their comments & forecasts on supermarket data, and data from hospitality multiples. They just don’t have visibility of the independent convenience sector.

“It was just the same with comments about the impact of MUP on sales of alcohol in Scotland. The authorities claimed in an NHS report that alcohol consumption had fallen. Our data showed that sales had increased in the independent sector – perhaps a shift from the multiples which no longer had a price advantage.”

Contact The Retail Data Partnership for more detailed up to date figures from the convenience sector.

NAM Implications:

- A common-sense kick-in?

- i.e. our gut-feeling that in times of stress/boredom/fear, people can turn to alcohol/spirits…

- …along with the obvious outlet via close-socialising.