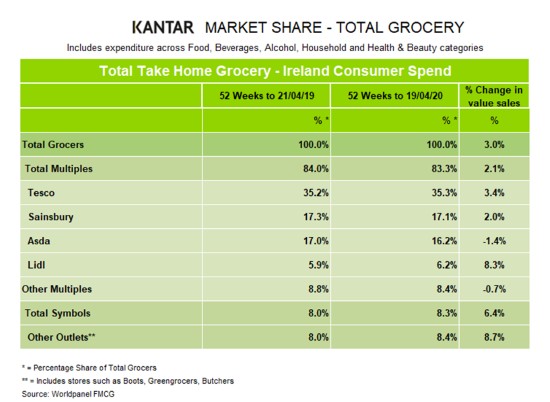

Latest Kantar figures show growth in the Northern Irish grocery market picked up pace again this month as shoppers adjusted to life under lockdown. Total take home grocery sales increased by 3% during the year to 19 April, with growth over the latest 12-week period increasing to 13.9%.

David Berry, Managing director – Ireland at Kantar, commented: “As people prepare and eat more meals at home, they have been making additional trips to the supermarket and picking up extra items each visit. The cumulative impact of this buying ‘a little bit more’ has been the real driver behind heightened expenditure this period. Volume sales were 1.2% greater than the previous 52 weeks which pushed spend up by £32.3m.”

Commenting on individual retailer performances, Berry said: “Lidl experienced the strongest sales growth at 8.3%, taking its market share to 6.2%. Shoppers at the discounter spent 4.9% more each trip than they did the year before and visited its stores 1.8% more this period.

“Northern Ireland’s largest retailer, Tesco, grew by 3.4% and gained 0.1 percentage points of share during the 52 weeks, as customers making extra trips, likely in the run-up to the lockdown, offset a drop in basket sizes as people adapted to the new normal. Tesco and Sainsbury’s were the only retailers to draw in new shoppers this period.

“Sainsbury’s experienced growth of 2% this month, buoyed by a 1.9% rise in shopper visits, while sales at Asda fell by 1.4%. Asda customers have continued to increase their spend in store, helping it achieve the strongest basket-size growth of all the major retailers at 7.8%, but the grocer has seen fewer shoppers come through its doors and existing customers visit less often.”

Similar figures released for the Republic of Ireland yesterday also highlighted continued strong growth, although retailers are feeling the effects of social distancing restrictions on food-on-the-go purchasing and other non-grocery categories.

NAM Implications:

- Issue will be the extent to which these changes in shopping behaviour become ‘permanent’…

- …coupled with the emergence of the super-savvy consumer….

- …now sensitised to the price difference between home-cooking and food sourced via hospitality.