Latest research reveals that retailers saw their sales fall by nearly a fifth in May as the coronavirus lockdown measures kept high streets empty. However, online sales hit record highs as people shopped from home.

According to BDO’s High Street Sales Tracker (HSST), total like-for-like sales, consisting of both in-store and non-store sales, declined by 18.3% in May. This was the second-worst result on record, just above April’s historic low due to the lockdown that has prompted a collapse in consumer discretionary spending.

While in-store sales fell plummeted, non-store like-for-like sales hit a record high with a 129.5% jump year-on-year as the shift to e-commerce continued to accelerate.

Lifestyle total life-for-like sales plunged by 30.0% in May, marking the fourth consecutive decline this year, and the second-lowest like-for-like on record for the category.

Similarly, fashion total like-for-like sales dropped by 22.6% – the third straight negative result for the sector. However, the category did see a slight improvement on previous months due to slightly higher online spending.

While in-store sales for homeware continued to show the impact of the lockdown with a 99.1% drop in May, total like-for-like sales were lifted 22% by the strong performance of some pure-play online retailers in the sector in addition to a higher proportion of sales across non-store channels in general.

Sophie Michael, Head of Retail and Wholesale at BDO LLP, commented: “Despite the significant pick-up in e-commerce, the monumental collapse in discretionary spend remains stark as retailers continue to face challenging headwinds.

“As shops look to reopen on the 15 June, they will face disrupted supply chains, mounting out of season stock and reduced footfall, as well as staffing uncertainty.”

Retailers are also facing hefty costs of implementing social distancing measures and protective equipment, such as plastic screens, PPE equipment for staff and hand sanitiser stations.

Michael added: “While government support so far has provided a lifeline, the reality is that the situation on the high street will remain critical for the foreseeable future. More than ever, retailers will be looking to both central Government and local authorities for creative solutions to ensure the high street has a viable future as lockdown restrictions continue to lift.”

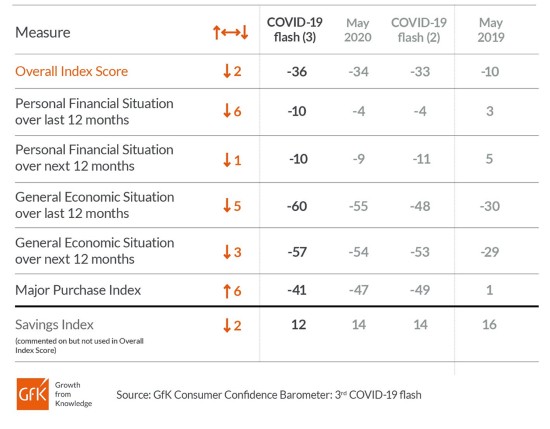

Separate data released today by GfK shows that its Consumer Confidence Index has decreased by a further two points over the past couple of weeks. The drop to -36 means the figure is just three points shy of the historic low of minus -39 in July 2008.

Joe Staton, GfK’s Client Strategy Director, commented: “Against a backdrop of falling house prices, soaring jobless claims, and with no sign of a rapid V-shaped bounce-back on the cards, consumers remain pessimistic about the state of their finances and the wider economic picture for the year to come.”

He added: “The only bright spark in the numbers is for the Major Purchase Index with a six-point fillip, pointing to latent demand among shoppers across the UK despite most outlets remaining shuttered. As the lockdown eases, it will be interesting to see just how the consumer appetite for spending returns in a world of socially-distanced shopping and the seismic shift to online retailing.”