Supermarket sales growth decelerated to 14.6% year-on-year during the four weeks to 12 July, down from 18.9% in June, as some consumers resumed more normal shopping routines and the hospitality sector began to reopen. The data from Kantar also shows that despite the economic downturn, branded goods are outperforming own label alternatives, whilst promotional activity is picking up.

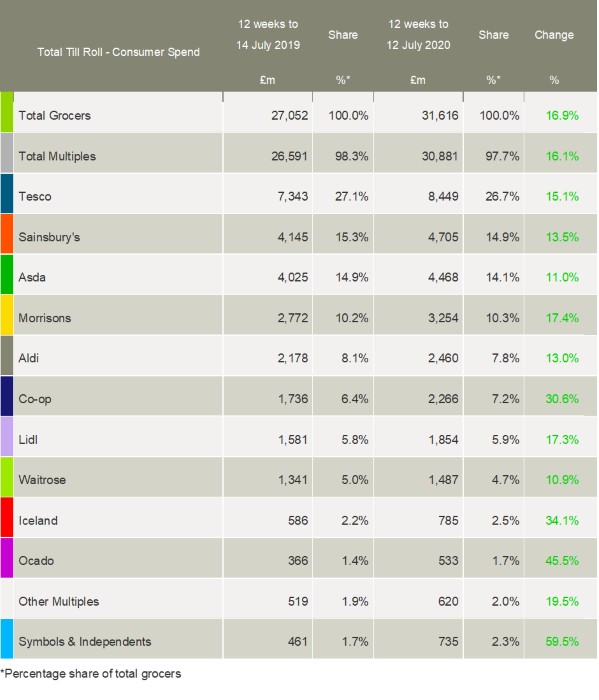

Over the longer 12-week period, the grocery market share figures show take-home grocery sales rose by 16.9%, the fastest growth rate since 1994. Total sales reached a record £31.6bn, reflecting three months of increased food and drink purchasing in supermarkets and convenience stores during lockdown while most other retailers, bars and restaurants were closed.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “As lockdown restrictions are gradually eased and non-essential retail outlets re-open, some consumers are slowly resuming their pre-Covid routines and shopping habits.

“However, we are clearly a long way off a complete return to normality. Footfall was still 15% lower during the past four weeks and the average spend on a supermarket trip was £25.05, 35% more than the same period last year, as most people continue to eat more meals and snacks at home.”

There are signs though that shoppers might be growing more confident and travelling further afield for their weekly shop. McKevitt explained: “Convenience stores were a lifeline for many people in the early days of the crisis, providing essential supplies close to home. Sales from these types of stores are still up by more than a quarter year on year, but they attracted 2.6 million fewer shoppers through their doors than at the peak of lockdown in April. Consumers are clearly growing more comfortable getting in their cars or taking public transport, as the average distance travelled to a grocer has gone up to 4.9km, a 10% increase from the April low.”

Co-op, the largest player in the convenience sector, grew its market share to 7.2% during the past 12 weeks after its sales increased by 30.6% year-on-year. Independent convenience stores, including those operating under names such as SPAR, Nisa and Premier, grew sales by 59.5% to reach a share of 2.3%.

The strong growth in online grocery sales has also continued with a 92% increase this month – marginally higher than the previous four weeks. Despite restrictions easing, more than one in five households still made an online order during the month. The channel now accounts for 13% of all grocery sales in Great Britain, which is up from 7.4% in March.

Ocado sales rose by 45.5% during the 12-week period, benefiting from its customer base increasing their shopping frequency by a third compared with last year. The online grocer’s market share rose by 0.3 percentage points to 1.4%.

All the ‘big four’ supermarkets experienced robust sales growth in line with the overall market trend. Morrisons was the star performer with its sales up by 17.4%, ahead of both Lidl (+17.3%) and Aldi (+13%). The UK’s fourth-largest group also gained market share for the first time since 2015, with it now standing on 10.3%.

Tesco sales rose by 15.1%, Sainsbury’s were up by 13.5% and Asda’s grew by 11%.

Iceland’s growth reached a new record high of 34.1%, with its market share increasing to 2.5% amid raised demand for frozen food during the lockdown. Over the 12 weeks, Kantar’s data shows that the total frozen food market increased sales by 22%, the second fastest growing category behind alcohol.

Meanwhile, the challenging economic climate has yet to have meaningful impact on the items shoppers are picking up in store. McKevitt said: “Even with the uncertainty that many consumers are facing, branded goods, which are typically more expensive, are outperforming cheaper, own label alternatives and grew sales 20% this period. In fact, it is the number one brands in each category that are typically winning share from rivals. Of the retailers’ own ranges, it’s the more premium lines, such as Tesco Finest or Sainsbury’s Taste the Difference, that are growing fastest. It seems shoppers are looking for small ways to treat themselves at home.”

Promotional activity at the grocers picked up in the latest four weeks, with 29% of sales including some type of discount. McKevitt commented: “Retailers scaled back promotions at the start of lockdown as they prioritised serving as many customers as possible and keeping shelves full. Now, they are putting the emphasis back on deals and collectively helped the average household save £45 on groceries this month.

“Promotional levels are still behind the pre-crisis level of 31% but, particularly given that the 2008 recession led to shoppers seeking out more discounts, we expect the grocers to bring in more enticing offers to attract cash-strapped shoppers in the months ahead.”

Kantar’s data shows that grocery inflation now stands at 3.6% with prices rising fastest in categories such as ambient cooking sauces, fresh bacon and canned colas while falling in fresh poultry, butter and bread.

NAM Implications:

- Patently key for NAMs to check variance re their sales vs individual retailers to identify opportunities in these changes.

- Meanwhile, despite increases in sales, reductions in mults’ shares can mean that the stage is set for a price war to end all price wars.

- And discounters unlikely to sit on sidelines.

- Watch this space…