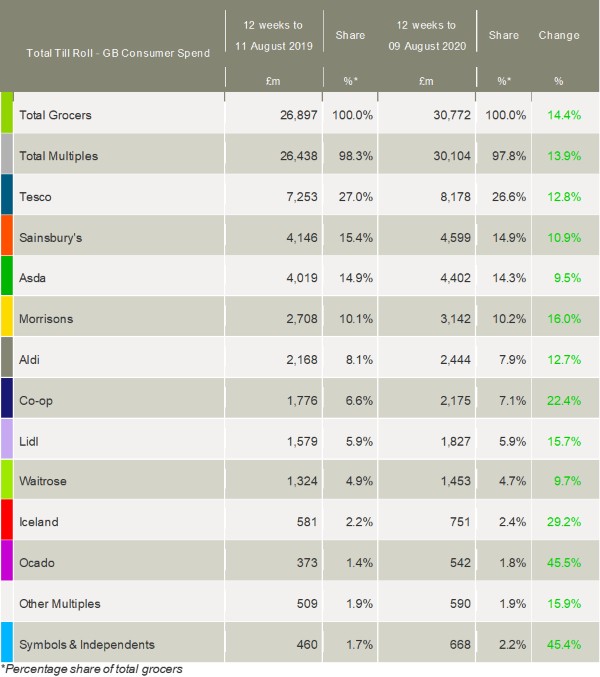

Latest data from Kantar shows the grocery market grew by 14.4% during the past 12 weeks, representing a slight decline compared with last month as consumer shopping habits continued to ease back to normality. However, the introduction of mandatory face coverings appears to have had a negative effect on visits to supermarkets with the share of the online channel hitting another record high.

With the market beginning to move away from the heady heights of the lockdown period, total grocery spend was £9.7bn over the past four weeks. This is the lowest since February, although it is still considerably higher than pre-pandemic levels with consumers still spending more each trip (£24) than they did before (£19).

The period saw the introduction of mandatory face coverings for visiting shops in England. Kantar found that the number of supermarket trips was two million lower than would have usually been expected in the week after the rule was adopted, and currently just over half of shoppers say they feel safe in stores. The research group stated that the figures suggest the public may need time to adjust to the new regulations, with people now having to plan ahead for every shopping trip.

One of the most significant lockdown trends, online shopping, reached another new record market share in the latest four weeks – with 13.5% of all sales now ordered through the internet. Ocado has been a major beneficiary of this, and it also hit a new record this month, registering a market share of 1.8% over the past 12 weeks and growth of 45.5%.

Elsewhere, wider economic issues are expected to continue to dictate how the market performs. Charlotte Scott, consumer insight director at Kantar, commented: “With the country officially entering recession last week, atypical behaviours are likely to continue. During a recession we would generally expect shoppers to manage their spend more carefully. Early evidence suggests that most are not yet choosing to trade down, with brands and premium own label lines currently performing well, however price cuts have increased compared with July as some people look for opportunities to save.”

August also marked the introduction of the Government’s Eat Out to Help Out scheme, designed to give a shot in the arm to the hospitality industry. Early indications suggest that the initiative has been successful, with a significant uplift in footfall at restaurants, cafes and bars between Monday and Wednesday over the past fortnight. Kantar suggested that exclusion of alcohol from the scheme may make that a resilient category for the grocers. Take-home alcohol sales over the past four weeks were up 28.3%.

Meanwhile, the past month has seen a renewed focus on health, with wellbeing high on shoppers’ agendas. Scott said: “People want to get back to their best after the long lockdown, and clean living is a priority again. Over the past month, we saw sales of vitamins and minerals grow at 34%, while herbal teas were up by 19% and nuts by 21%.”

Over the latest 12 weeks period, all the major retailers registered strong growth in take-home sales. However, all bar Ocado saw that growth slow compared with July.

Morrisons remained the fastest-growing big four supermarkets and even outperformed Aldi and Lidl. The group’s sales were up 16% and its market share increased to 10.2% as its supermarket stores attracted more shoppers.

Despite Tesco being close behind in terms of growth, it lost market share of 0.4 percentage points bringing it to 26.6%. Sainsbury’s share now stands at 14.9%, losing 0.5 percentage points this month, while Asda lost 0.6 percentage points taking it to 14.3%.

Iceland was the second-fastest growing retailer at 29.2%, whilst the symbols & independents sector continued to perform well with growth of 45.4% as consumers continued to shop locally.

Lidl managed to hold its share steady at 5.9%, while Aldi and Waitrose both lost 0.2 percentage points taking them to 7.9% and 4.7% respectively.

Kantar’s data shows that grocery inflation stood at 2.9% over the 12-week period with prices rising fastest in markets such as ice cream, canned colas and household cleaners, while falling in fresh poultry, butter and vegetables.

NAM Implications:

- Key for suppliers is how your sales compare to these stats by retailer and category…

- …as a way of identifying opportunities that can be optimised.

- …whilst minimising some of the losses re under-trading.