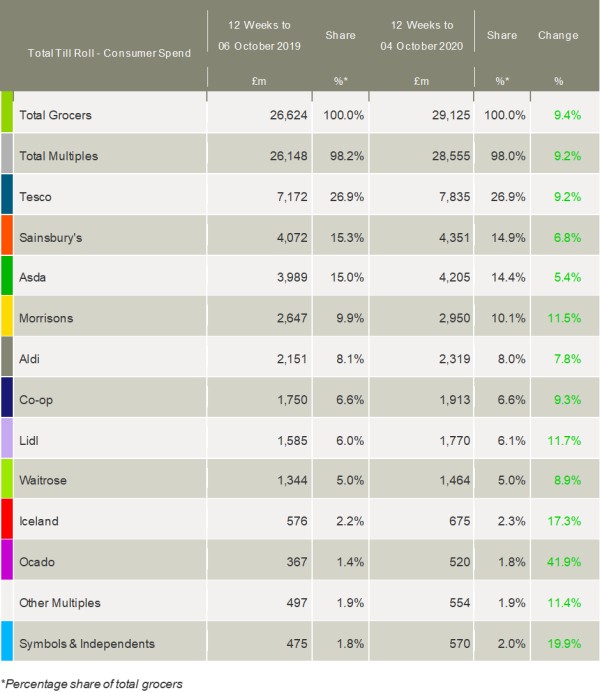

Latest grocery market share figures from Kantar show take-home grocery sales rose by 9.4% during the 12 weeks to 4 October 2020. However, over the latest four weeks, sales growth accelerated to 10.6% as shoppers moved a greater proportion of their eating and drinking back into the home in response to rising Covid-19 infection rates, greater restrictions in the hospitality sector, and the end of the government’s ‘Eat Out to Help Out’ scheme.

Alcohol sales alone were worth £261m more to the grocers this month than last year after pubs and restaurants were limited by the 10pm curfew.

However, despite media reports to the contrary, Kantar found there was only limited evidence of consumers stockpiling at a national level in the past month. Fraser McKevitt, head of retail and consumer insight, said: “The seven days from Monday 21 to Sunday 27 September were the busiest since March, with 107 million trips recorded, but that number was nowhere near the 175 million seen just prior to the first national lockdown. That said, sales of toilet roll and flour rose by 64% and 73% during the week, showing that consumers were wary of potential new restrictions.”

Meanwhile, online sales continued to soar and were up 76% in the past month on a year ago, with one in five households ordering groceries via the internet. The proportion of sales made digitally remained unchanged from last month at 12.5%, suggesting that many shoppers are choosing to stick with deliveries as the pandemic develops.

Ocado continued to benefit from the trend, growing its 12-week sales by 41.9%. The online grocer increased the number of shoppers using its service in the latest period – the only retailer to do so – adding 22,000 customers. Kantar suggested this was partly down to Ocado’s new partnership with Marks & Spencer.

However, its previous product partner Waitrose was once again the fastest-growing retailer online this month, albeit starting from a relatively low base. It also increased sales through its physical stores, with overall sales rising by 8.9%.

Lidl continued its run of double-digit growth that started in December, accelerating its rate in the past 12 weeks to 11.7%. Iceland, which is marking its 50th birthday in November, also had cause for celebration, as its growth came in a 17.3%.

Despite its ambitious store opening programme and moves online, Aldi’s growth slowed from 10.0% in the last period to 7.8%, with its market share falling slightly to 8.0%.

Meanwhile, Morrisons maintained its recent strong performance and gained market share, up by 0.2 percentage points to 10.1% on the back of 11.5% growth. Sainsbury’s increased sales by 6.8% but its market share slipped to 14.9%.

Changing personnel was the major story for Tesco in the latest period. McKevitt commented: “New Tesco CEO Ken Murphy took over the reins at Britain’s biggest supermarket in October, with positive news to report – Tesco maintained its market share year-on-year for the second period in a row. It now holds a 26.9% slice of the market – backed by sales growth of 9.2%. Frozen, an early focus for the retailer’s Clubcard-only promotions, was the single fastest-growing food category for Tesco.”

Asda, which is now set for a change in ownership, saw its sales grow by a relatively disappointing 5.4% with its market share falling to 14.4%.

Meanwhile, the buoyant convenience channel started to see annual growth rates fall back in line with the market. The single biggest operator, Co-op, held market share at 6.6%, with growth of 9.3%. Growth in symbols & independents also slowed to 19.9%.

Kantar’s data showed that grocery inflation stood at 1.9% for the 12-week period with prices are rising fastest in markets such as canned cola, ice cream and household cleaners while falling in vegetables, bread and fresh poultry.