Sales growth in the supermarket sector has remained robust in recent weeks despite the reopening of non-essential retail and some hospitality venues. The latest data from Kantar shows take-home grocery sales rose by 5.7% during the 12 weeks to 18 April, with the figure accelerating to 6.5% in the latest four-week period.

The research group suggested that this was partly due to people becoming more comfortable with venturing out to the supermarket as the pandemic eases. The past four weeks were the busiest in store for the grocers in more than a year, with the number of trips made in April increasing by 4% compared to March. With much of the over-65 community now vaccinated, older shoppers accounted for nearly half of the increased footfall.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “The return to overall sales growth in the latest four-week period also reflects what was happening in April 2020, a highly unusual month for grocery shopping. After the initial pre-lockdown rush, this time last year was comparatively quiet. Shoppers chose to buy locally and limit their trips to store where possible, which is reflected by strong growth a year later.

“While the market may fluctuate between growth and decline in the months ahead, depending on the year-on-year comparison being made, the fact that trip numbers are up and basket sizes down suggest that habits are slowly returning to normal.”

April also saw the reopening of pubs and restaurants for outdoor drinking and dining, which resulted in sales of alcohol in grocery retailers growing by just 1% in the latest four weeks. McKevitt said: “The return of wider retail and hospitality will naturally have a knock-on effect for the grocers.”

Meanwhile, having seen dramatic growth over the last year, the online channel experienced a further slowdown with the number of people ordering groceries via the internet falling for the second time in a row. Online’s share of the market in the most recent four weeks slipped to 13.9%, down from a peak of 15.4% in February. The channel is still growing strongly at 46%, but this rate is half of what it was at the height of the pandemic.

Convenience stores – both independents and those owned by major retailers – were also particularly popular during the first lockdowns. However, against these tough comparisons, sales in the channel have unsurprisingly fallen by 19% in the past month.

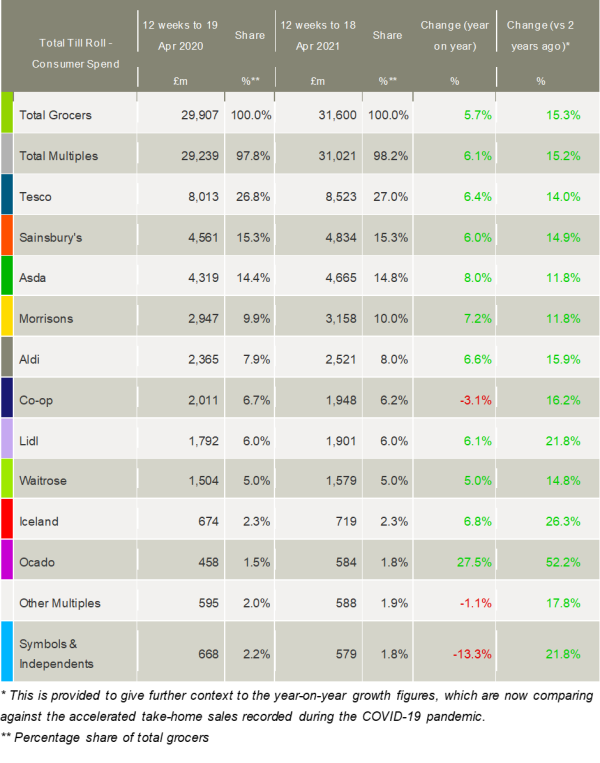

Co-op, the most prominent convenience retailer, saw sales decrease annually by 3.1% over the 12 weeks, following its particularly strong performance at the same time last year. However, in comparison with a more normal 2019, the chain’s sales are up a healthy 16.2%. It is a similar story for independent stores and symbol retailers, with a year-on-year decline of 13.3% masking the fact that sales are 21.8% higher than two years ago.

Ahead of its new owners taking control, Asda was the fastest growing of the big four supermarkets for the first time in nearly two and a half years. Its larger stores were visited less often by shoppers looking to stay local in the early days of the pandemic, but footfall has now returned strongly. Asda’s share of the market increased by 0.4 percentage points to 14.8% this period, on the back of 8.0% growth.

Tesco also gained market share, moving to 27.0% from 26.8% last year. Its sales rose by 6.4% over the 12 weeks.

Morrisons grew by 7.2%, with its share increasing by 0.1 percentage points to 10.0%. Sainsbury’s share remained at 15.3% after sales climbed 6.0%.

Meanwhile, after a disappointing run, Aldi’s share grew for the first time in a year, to 8.0%, as its sales grew by 6.6%. Lidl’s growth of 6.1% was enough to hold its share of the market steady at 6.0%.

Waitrose’s share remained consistent at 5.0%, and its sales grew by the same amount. Iceland enjoyed overall growth of 6.8%.

In line with the wider online market, Ocado’s growth slowed to 27.5%, but the retailer still held on to its position as the fastest-growing grocer.

Kantar’s data shows that grocery inflation currently stands at -0.3%, falling for the first time since December 2016. Prices rose fastest in markets such as chilled fruit juices & drinks, canned colas and chocolate, while falling in fresh bacon, vegetables and toilet tissue.

McKevitt commented: “There has been a lot of talk about grocery prices this year, and shoppers will welcome the news that like-for-like take-home grocery prices are lower than in 2020. This is largely down to promotions, as retailers prioritised filling shelves over running deals last year. Compared with April 2020, an extra £582m of groceries were sold on offer, most of which were straightforward price cuts.”

NAM Implications:

- Trip numbers up and basket sizes down…

- …suggesting that shopping habits are slowly returning to normal.

- i.e. a negative impact of social distancing sales-resistors being reversed.

- Online’s share in the last four weeks slipped to 13.9%…

- ..down from a peak of 15.4% in February.

- i.e. still growing strongly at 46%, but half of mid-pandemic peak.

- Asda on the way back, despite change of ownership distractions.

- NB. Grocery was the healthiest retail sector in Lockdown…

- i.e. This is the best you could get in retail…