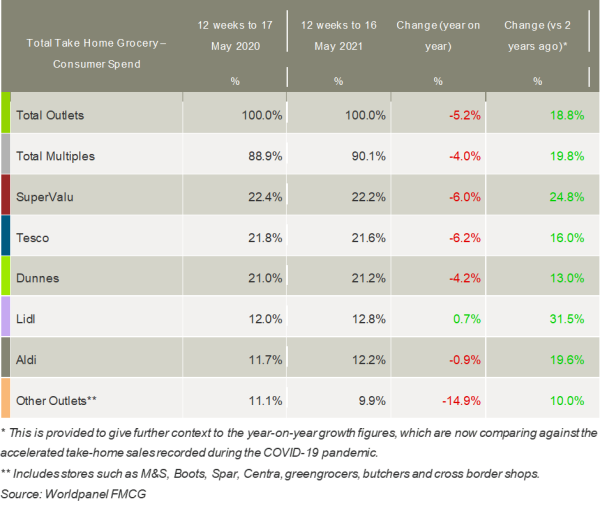

Latest figures from Kantar show that the grocery market in Ireland declined by 5.2% year-on-year in the 12 weeks ending 16 May, and by 6.9% in the latest four-week period, up against record growth at the height of the country’s first Covid-19 lockdown.

Emer Healy, retail analyst at Kantar, commented: “While grocery sales may have dipped this month, that does reflect a tough comparison against the unprecedented spend we saw this time last year. People are still filling their baskets more than they were before the pandemic, and if we compare the past 12 weeks to the same time two years ago, sales are actually up 18.8%.”

There was also positive signs that consumer confidence is on the rise. Healy said: “With the ongoing vaccine rollout and social distancing restrictions starting to ease, Irish shoppers are beginning to head back out and visit the shops more often. Consumers made an additional 2.1 million trips to the supermarket in the latest four weeks when compared with last year. Retired people in particular are leading the charge. They visited the grocers an extra 380,000 times this month.

“The data suggests that once more restrictions are lifted, shoppers will be keen to get back to their town centres. We’ve already seen people embracing the reopening of beauty salons this month, for example. Irish shoppers have taken the chance to pamper themselves rather than trying their hand at home makeovers. Sales of haircare and hair colourants have dropped by 7.4% and 9.4% as a result.”

However, with lockdown rules still in place for much of the retail and hospitality sectors, Kantar found that shoppers have not shaken off all their lockdown habits just yet and many of the major themes of the past year prevailed again this month. This includes online shopping with sales in the channel over the latest 12 weeks jumping 38.3%, adding €43.1m to the market. Empty nest families led the growth, boosting sales by 113% and spending an additional €11.2m in online shops versus last year.

Meanwhile, since the early days of the pandemic, shoppers have stayed closer to home for their supermarket trips and made a greater effort to support Irish brands. Healy commented: “We can see a real desire among shoppers to buy local. Irish brands have gone from strength to strength, and our data shows that Irish-made products and brands are generally growing faster than their imported counterparts. SuperValu and Aldi have both announced that they will be increasing the number of Irish products in store, and the likes of Tayto, Brennans, Avonmore, Denny and also Cadbury, which is manufactured in Dublin, and have performed especially well in the past year.”

SuperValu continued to hold the largest share of the grocery market at 22.2%. Its growth was primarily driven by shoppers returning to store more often, contributing an additional €41m.

Tesco remained in the second-highest position with a share of 21.6%, while Dunnes accounted for 21.2% of grocery sales in this period. Both Tesco and Dunnes benefited from growing confidence among shoppers and attracted new customers into stores in the past 12 weeks, with shopper numbers up 25,100 and 28,200 respectively. Aldi also brought more customers through the doors, boosting sales by €9m and helping it to retain a 12.2% share.

Lidl was the only retailer to grow in the past 12 weeks, increasing sales by 0.7% to account for 12.8% of the grocery market. This was largely due to shoppers spending an extra €9.1m on branded items in store.

NAM Implications:

- Again, Lockdown can be seen as an accelerator of trends.

- Companies in trouble being pushed closer to the edge…

- …successful business models, like online, growing faster.

- Lidl vs Aldi growth could rachet up directly competitive moves…

- [Cross-border sales: now mentioned in ‘Other Outlets’. Given relative market dynamics, it would be illuminating if Kantar could separate for NI and ROI]

- The issue will be the extent to which areas like hospitality and travel will recover.

- i.e. those anticipating or depending upon 100% recovery…

- …need to run the (realistic) numbers.