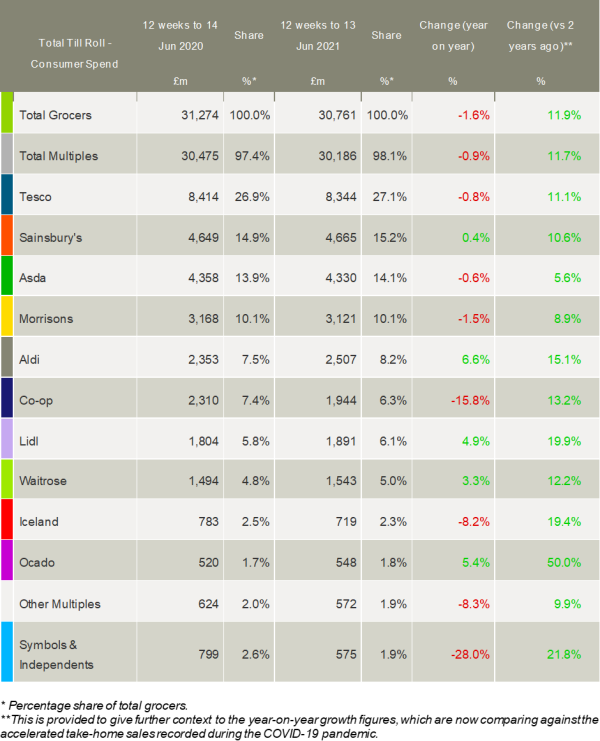

Latest industry data suggests supermarket shoppers are returning to their old habits as restrictions ease and the hospitality sector reopens. This appears to be benefiting Aldi and Lidl the most, although the majority of the big four chains gained market share as trade in convenience stores weakened.

Take-home grocery figures from Kantar show that sales fell by 1.6% during the 12 weeks to 13 June. While the number of grocery trips remained lower than in pre-covid times, since last year there has been a 13.1% increase in the number of shopping visits made each month by households. As visits to store rise, there has been a corresponding fall in the average spend per trip, down 13.6%, metrics which suggest a return to more typical shopping patterns.

“While it’s encouraging to see shoppers returning to the habits of old, there is still a way to go before the market entirely returns to normal,” said Fraser McKevitt, head of retail and consumer insight.

“That’s demonstrated by the fact that sales in the past 12 weeks were still £3.3bn higher than in 2019 before the pandemic hit. Retailers will also be benefiting from sales of goods consumed on-the-go, such as picnics and lunches eaten at work, which are not captured in these numbers.”

Kantar’s data shows that supermarket footfall in the latest four weeks was down by five million trips compared with May. As expected, the re-opening of indoor hospitality in certain parts of the country took some spend away from the grocers. However, despite pubs and restaurants being open, take-home sales of alcohol increased by £29m compared to May thanks to the bank holiday and the start of the European football championships.

Meanwhile, online sales accounted for the same proportion of the market – 13.4% – in the four weeks to 13 June as they did in May. This plateau, and the fact that year-on-year sales were up by just 0.2%, suggests the appetite for large online shops is approaching a new baseline. McKevitt commented: “A really interesting recent development in online shopping is the rapid growth of fast-track delivery services for smaller top-up shops. Tesco launched its Whoosh platform in May to compete against start-up disruptors including Gorillas, Getir and Weezy which are moving into the market for smaller trips, with baskets under £25 currently worth £41bn online and in-store each year. It’s definitely a case of ‘watch this space’.”

The shift towards the online channel during the pandemic has been one of the reasons why Aldi and Lidl have experienced weaker performance in recent times. However, as shoppers revert to more typical habits, the two discounters are finding success again and making gains on their rivals.

Aldi was the fastest-growing retailer over the 12 weeks period, with sales up by 6.6%. Much of its gains came from older shoppers who, having been vaccinated, are now more confident about visiting stores. Aldi’s market share increased as a result by 0.7 percentage points to 8.2%, matching its highest ever in March 2020. Lidl also enjoyed growth of 4.9% and saw its share increase from 5.8% to 6.1% this period.

Recent concerns about inflation in the wider economy have yet to materialise in the grocery market, where prices paid fell by 1.9% year-on-year. Kantar suggested that this is partly because of an increase in the number of promotions currently on offer – this period 29.6% of all grocery spending was done on some kind of deal, up from 26.4% this time last year.

Sainsbury’s has had an eye on value with its ongoing price match campaign this year, and its market share has moved up by 0.3 percentage points to stand at 15.2%. Tesco gained 0.2 percentage points of market share this period, marking the fifth consecutive month that it has increased, something which it hasn’t done since 2010.

Asda also made gains, with footfall up by 29%, more than any other big four retailer. Its market share also grew from 13.9% in 2020 to 14.1%.

Morrisons’ market share remained at 10.1% as it annualised against strong growth in June last year. McKevitt said: “Morrisons’ share price has jumped following private equity interest which came to light over the weekend. This follows nearly a year of solid retail performance for the grocer. In July last year it shrugged off several years of underperformance, and since then it has grown faster than the market each month until this one.”

Meanwhile, the Co-op’s market share fell back from 7.4% to 6.3% this period, with independent convenience store operators seeing a similar pattern as shoppers start to use them more on the go but rely on them less for take-home groceries.

Frozen food was popular during last year’s lockdowns, an effect which is now slowing down for Iceland, with its share falling to 2.3% of the market from 2.5% 12 months ago.

Ocado’s growth slowed to 5.4% as demand for online groceries stabilised, although it is worth noting that compared with two years ago it has seen a 50% increase in sales.

Waitrose enjoyed growth of 3.3% this period, meaning market share increased by 0.2 percentage points on a year ago to 5.0%.

NAM Implications:

- Key development in online shopping is the rapid growth of fast-track delivery services for smaller top-up shops.

- i.e. Woosh, Gorillas, Getir and Weezy for smaller trips, with baskets under £25 currently worth £41bn.

- Vital to maintain efficiency/profitability of this model given relative high cost of fulfilment.

- Take-home sales of alcohol increased by £29m compared to May, despite pubs opening.

- i.e. probably momentum following drinks brands promoting retail sales to compensate loss of on-trade.

- Discounter shares growing again as some online reverts to traditional retail.

- Above all, three mults on the brink of ownership change: Sainsbury’s, Asda, Morrisons, could destabilise the above.