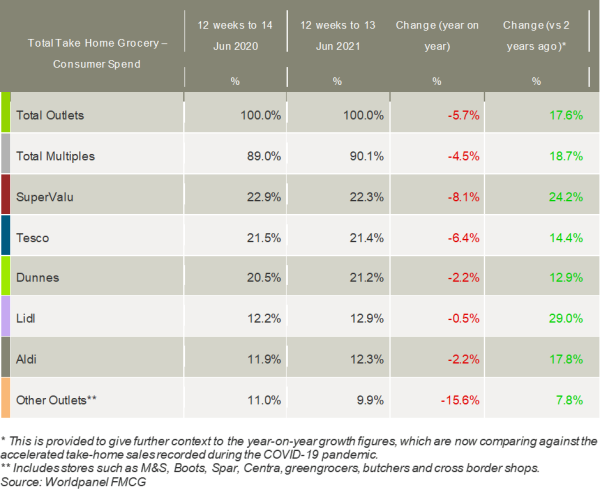

Latest figures from Kantar show that sales in Ireland’s grocery market declined by 5.7% year-on-year during the 12 weeks to 13 June 2021. The decline accelerated to 7.0% in the most recent four weeks as warmer weather and outdoor hospitality returned and the market continued to annualise against the exceptionally high levels of spending in supermarkets during the first lockdown.

Emer Healy, an analyst at Kantar, commented: “Grocery sales may be lower than last year, but we are still a far cry from normal life. Spending in the latest 12 weeks was an incredible 17.6% higher than before the pandemic and the average Irish household spent €218 more on groceries than 2019. That being said, there are early signs of newfound freedoms in Irish shopping baskets.

“With outdoor hospitality returning on 7 June, people have finally been able to enjoy a night away from the kitchen. Sales of home cooking ingredients like oils, herbs and spices, and ready-made sauces declined by 14.9% in the latest 12 weeks and shoppers spent €94.4m less on alcohol in the supermarkets as they returned to pub gardens. It’s clear that we’re edging back to eating and drinking out, but sales of take-home alcohol are still a whopping 36.4% higher than before the pandemic and, now that people can visit friends at home, some of their spending will have been redirected to on-the-go purchases, which are not captured in this data.”

The data also suggests that shopper confidence is gradually returning in Ireland as the vaccine rollout continues. Healy explained: “Warmer temperatures and vaccine numbers mean many of us are feeling happier to pop to the shops and make more frequent, smaller trips – visits were up 1.7% this month and basket sizes shrank by 8.1%.

“The tide may also have turned on one of the biggest trends of the past year – online sales declined by 4.4% in the past four weeks, the first drop since March last year. Retired households are driving this trend and spent €2.4m less online than last year – a clear indicator of rising confidence.”

SuperValu remained the largest grocer in Ireland during the past 12 weeks with a 22.3% share of the grocery market. The retailer benefited from shoppers visiting stores more often than this time last year, adding an extra €75.4m to its takings. “SuperValu’s phenomenal growth during the past year will mean some tough comparisons in the next few months,” said Healy. “However, we shouldn’t lose sight of the longer-term context – the supermarket has grown by 24.2% since 2019, well ahead of the overall market at 17.6%.”

Tesco maintained its second position in the table with a market share of 21.4%. Its performance was boosted by new shoppers, which contributed an additional €29.2m to its overall performance. Dunnes, which accounted for 21.2% of grocery sales this period, also welcomed new shoppers during the latest 12 weeks and encouraged existing customers to return to store an additional 1,800,000 times.

Both Aldi and Lidl benefited from the return to stores and the slight shift away from online shopping this period. Lidl held 12.9% of the market, 0.7 percentage points higher than last year, and Aldi’s market share edged up to 12.3%.

NAM Implications:

- Some anticipated fall in online but underlying growth trend continues.

- Similarly, discounters continue to benefit in terms of brick & mortar shares.