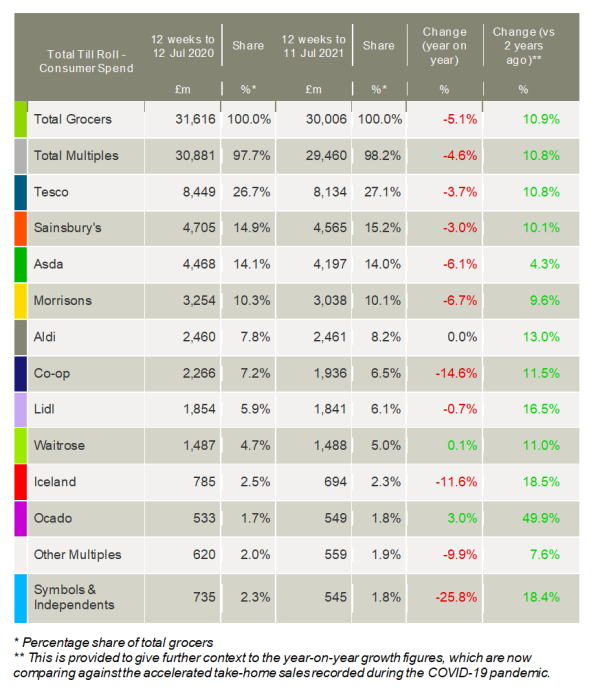

Latest data from Kantar shows demand for take-home groceries has continued to ease from last year’s records highs, with sales down 5.1% year-on-year during the 12 weeks to 11 July as more normal trading conditions returned and less shopping was done online. However, sales are still elevated compared with pre-pandemic times and shoppers spent £3bn more on groceries than they did during the same period in 2019.

Kantar highlighted that the Euro 2020 football tournament provided a significant boost to supermarkets with sales of crisps and snack brands up by 23% compared with two years ago. However, take-home sales of alcohol over the four weeks to mid-July were actually down by 3% compared with the previous month as fans choose to make the most of newfound freedoms and watch the matches in pubs and bars. That said, shoppers still spent £1.2bn in the category – a 24% increase on the same period in 2019.

Meanwhile, with people feeling more confident about visiting stores, the number choosing to buy groceries online fell by 81,000 in July compared with the same four weeks last year. As the nation returned to shops, workplaces and restaurants over the past month, digital baskets shrunk by 8% to an average of £80 per shop, the lowest since February 2020. As a result, year-on-year sales growth for online groceries dropped for the first time ever – falling by 2.6%. The channel currently accounts for 13.3% of the total market.

With online’s rapid rise starting to taper, Ocado’s growth also slowed over the 12 weeks to 3.0%, although it remained the fastest-growing retailer and increased its market share by 0.1 percentage points to 1.8%. Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “A number of the grocers saw sales fall this month but there were notable gains for some. Waitrose, with sales up by 0.1% over the 12 weeks to 11 July, was the only retailer with a bricks and mortar estate to achieve year-on-year sales growth. Waitrose lost shoppers last year when people focused more on picking up essentials and limiting trips outside the home. But as the nation becomes more confident and starts to buy groceries from multiple places again, it has outpaced its peers with increasing footfall and as a result its market share rose by 0.3 percentage points to 5.0%.

“Aldi and Lidl both won market share this period. Aldi gained 0.4 percentage points to hold 8.2% while Lidl’s share of the market increased by 0.2 percentage points to 6.1%. Tesco won its biggest year-on-year share increase since December 2016 this period, growing from 26.7% last year up to 27.1% in the latest 12 weeks.”

Sainsbury’s, where online sales continue to perform strongly, moved its share up to 15.2% from 14.9% last year. Asda’s share slipped by 0.1 percentage points to 14.0% and Morrisons fell from 10.3% last year to 10.1% this period.

McKevitt added: “Morrisons has made plenty of headlines this month following private equity interest in the business; a change of ownership in the near future looks to be highly likely. Following a year of solid sales performance, shoppers are clearly pleased with what the Bradford-based grocer has offered. It sets itself apart from the competition through its distinctive fresh counters and a continued use of multibuy promotions. While other retailers have cut back on counters, 14% of Morrison’s shopping trips include loose meat, fish, dairy, or delicatessen items from its Market Street sections, more than double the market average. Over 30% of promotional sales in Morrisons are multibuy offers, requiring the customer to buy two or more items. This is in contrast to its big four rivals which have largely focused efforts on price cuts.”

Having received a boost in the early days of the pandemic as people shopped closer to home, Iceland, Co-op and independent stores have been losing market share in recent months. However, all three experienced double-digit sales growth compared with 2019.

Despite growing inflationary pressures, Kantar’s data shows that grocery prices fell 1.5% for the 12-week period. Prices rose fastest in markets such as ambient cakes and pastries, savoury snacks and cat food while falling in fresh bacon, ambient cooking sauces and vegetables.

NAM Implications:

- For many consumers, 17 months was a sufficient period for online grocery to become a habit…

- …providing retailers maintain fulfilment fees, and preserve availability levels ‘on virtual shelf’.

- As always, the two-year comparisons reveal the most…

- …and meanwhile, those pesky discounters…