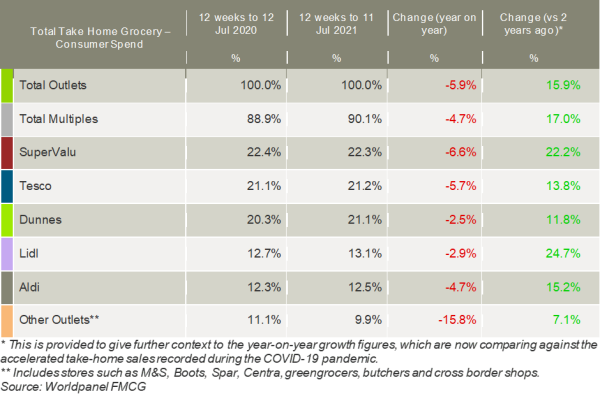

Latest figures from Kantar show that grocery sales in Ireland declined by 5.9% in the 12 weeks to 11 July and dipped by 3.6% in the most recent four weeks as people enjoyed their renewed freedoms amid the easing of Covid restrictions. However, sales remained strong compared with pre-pandemic times and the average household spent €189.98 more in the latest 12 weeks than the same period in 2019.

Emer Healy, retail analyst at Kantar, commented: “Whether you are a devoted football fan or not, the Euros 2020 certainly provided a welcome excuse to head out to newly reopened pubs and restaurants and reconnect with friends and family. It meant take-home sales of classic pub snacks like crisps and nuts fell 1.6% and 2.9% respectively compared to the previous four weeks, and supermarket alcohol sales dropped by 1.5%. We’re not back to normal just yet though – with indoor hospitality still closed, shoppers spent €58.9m more on take-home alcohol than before the pandemic in 2019.

“Getting out and about more also means a little less time spent cooking meals from scratch at home. In the latest four weeks, consumers spent €4.8m more on chilled convenience items like pizzas and prepared salads and €2.4m more on chilled ready meals – a reversal of the behaviour we saw throughout national lockdowns.”

As seen in the UK, the recently buoyant online grocery channel saw sales decline as people began to venture out and visit stores more. Online sales dipped by 6.1% in the latest four weeks as shoppers reduced the size of their orders. Kantar highlighted that this trend is most pronounced in urban areas where shoppers have more options to pop to local shops – online sales dropped a much bigger 24% in Dublin this month. “It’s an early indication that city and country may move out of the pandemic slightly differently,” said Healy.

SuperValu continued to hold the biggest share of the grocery market at 22.3% during the 12 weeks. The retailer attracted its customers into store 20.9 times on average over this period, the highest frequency among the grocers.

Tesco accounted for 21.2% of grocery sales this period, holding its spot as the second-largest retailer. The grocer won new shoppers and encouraged more frequent trips which contributed €8m and €46.6m to its takings respectively.

Dunnes captured 21.1% of the grocery market this period, as it also welcomed new shoppers and encouraged existing shoppers to return to store more often. The chain continues to achieve the highest spend per buyer out of the retailers and its average household spent €558.64 over the 12 weeks.

Meanwhile, the discounters continued to make gains with Lidl achieving a record-breaking 13.1% market share this period and was the only retailer to convince its customers to spend more on branded products than last year. Aldi held 12.5% of the market, welcoming new shoppers in store that contributed €7.5m to its tills.