Latest data from NielsenIQ shows the recent year-on-year decline in grocery sales eased this month as trade in supermarkets was boosted by better weather, Euro 2020, and people choosing to spend their holidays in the UK.

Over the four weeks ending 17 July, total till sales edged down only 1.3% versus the same bumper period in 2020 when demand was being boosted by the effects of the pandemic. This was an improvement on the 2.4% fall in June and 2.7% decline in May when hospitality venues first reopened.

The effects of the recent heatwave were particularly prevalent in the final week ending 17 July, when sales increased by 1.5% – the highest weekly growth since the week ending 12th June (+3.2%).

With more occasions to socialise in groups, NielsenIQ’s data shows supermarkets experienced a shift in category spend towards fresh food. Delicatessen was the fastest-growing category (+9.4%) over the four week period, driven by sales of rotisserie (+43%), sandwiches (+31%), freshly prepared fruit (+27%), prepared pasta salads (+15%) and coleslaw (+8%). This was complemented by rising sales within bakery (+9.4%), which was the second fastest-growing category. In contrast, there continued to be a move away from cupboard food with packaged grocery sales falling 9%.

Sales of lager grew by 22% in the final week of the period after people had stocked up for the Euro 2020 football final on the previous Sunday. However, overall category sales for beers, wines and spirits within the full four weeks to 17 July declined by 6% compared with the same period last year. This is in line with market expectations considering the closure of all hospitality venues for most of this period a year ago.

NielsenIQ’s data also reveals that in-store sales declined by 1.7%, despite 11% growth in store visits over the four-week period. Moreover, online grocery sales fell by 3.6%. However, online continues to maintain its market share of 13.4% for all FMCG similar to the 13.6% a year ago, suggesting that post-pandemic ‘new normal’ shopping behaviours are starting to emerge.

When compared to 2019, FMCG growth in the last four weeks was 7.6%, which is an indication of the continuing strong underlying demand.

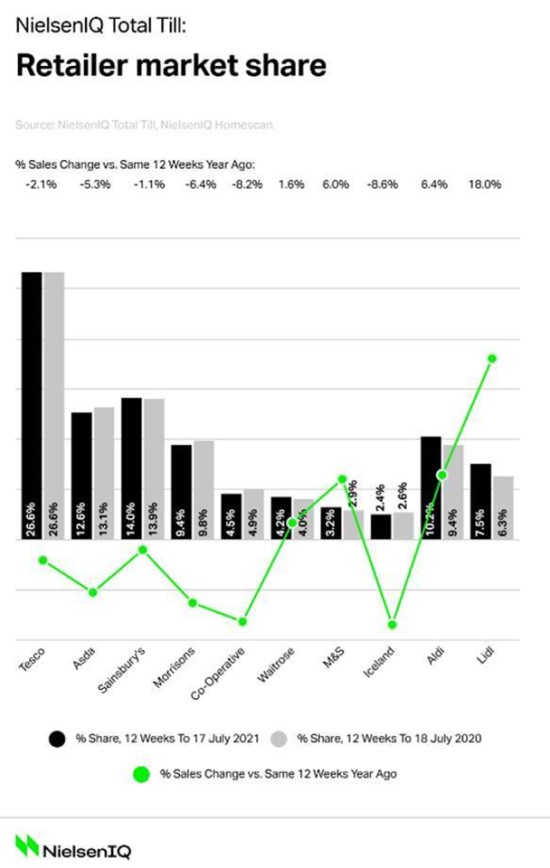

In terms of retailer performance over the last 12 weeks, Lidl (18.0%) and Aldi (6.4%) continued to lead the market in terms of growth. Marks & Spencer (6.0%) also experienced strong performance, whilst Sainsbury’s (-1.1%) was the best performing supermarket of the Big 4 with its market share increasing to 14%.

“The year-to-date growth among the grocery multiples is currently at 3%, which shows promise for the upcoming summer period,” said Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight.

“The continued demand for staycations and hopefully good summer weather will certainly put retailers in a strong position to gain incremental sales, with fresh and chilled foods as well as drinks expected to be popular categories with shoppers.”

However, Watkins warned that there are two possible headwinds on the horizon. He said: “The first is that as consumer demand increases in recreation and leisure, this will dampen FMCG spend. The second, is that 4 in 10 households are now watching their spend more than they did before the pandemic, and should shoppers start to tighten wallets then retailers and brands would be under pressure to drive sales with promotions and price cuts.

“Looking ahead, and assuming economic activity will be close to pre-Covid levels after the summer, we can then expect further normalisation of total till spend later in the year with the full-year growth probably in the range of -1.5% to +1.5%.”

12-Weekly % Share Of Grocery Market Spend By Retailer And Value Sales % Change

NAM Implications:

- As always, the key is to compare your sales by sector and category.

- Meanwhile, in terms of potential headwinds (increased hospitality diluting retail, emergence of the super-savvy consumer reining spend)

- It may be worth factoring in a hefty dose of inflation…