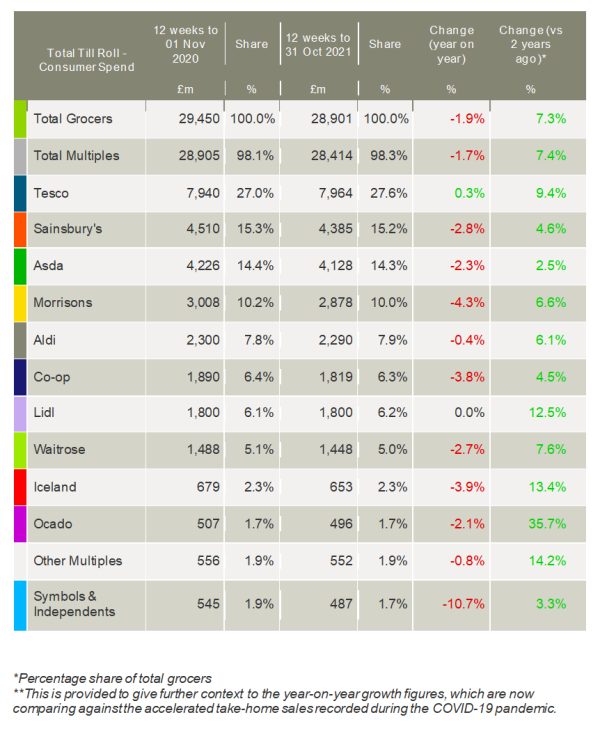

Latest figures from Kantar show take home grocery sales fell by 1.9% over the 12 weeks to 31 October, although they are still 7.3% higher than pre-pandemic levels in 2019.

The data suggests that shopping habits established during the crisis are beginning to settle at a new baseline. The general trend towards bigger, less frequent trips to the supermarket seems set to stay with consumers still making 40 million fewer trips per month than they were in 2019.

Online sales have also levelled out. For the second month in a row, digital sales accounted for 12.4% of the total grocery market.

Meanwhile, as flagged by manufacturers and retailers in recent months, prices in the sector are creeping up as raw material and logistics costs increase. Kantar’s data shows like-for-like grocery price inflation in the latest four weeks reached 2.1%

It is suggested that shoppers could now start to seek out better value with Fraser McKevitt, head of retail and consumer insight at Kantar, commenting: “Grocery prices are rising and this month inflation hit its highest rate since August 2020, when retailers were still cutting promotions to maintain stock on the shelves.

“As prices increase in certain categories, we can expect shoppers to continue to visit several supermarkets and shop around to find the best deals. Already, households visit an average of 3.3 supermarkets per month in order to find the best value for money.”

However, shoppers still appear keen to make the most of key calendar milestones this year. McKevitt said: “After a tough 18 months, consumers are gearing up for bigger and better celebrations. An unrestricted Halloween drove sales of pumpkins up 26% in the four weeks to 31 October, and with trick or treating back on the cards, seasonal confectionery grew by 27%.

“With Christmas ads out earlier than ever and Christmas stock on the shelves, we’re keen to prepare early this year so we can dive headfirst into festivities. 4.7 million households bought mince pies this month. Customers are also getting ahead on shopping for the big day itself. Frozen poultry sales are 27% higher year-on-year, with people spending an additional £6.1m in the latest four weeks. 1.6 million households bought their Christmas pudding this month as well, 400,000 more than last year.”

Looking at individual retailer performances, Tesco bucked the wider market decline and was the only retailer to achieve year-on-year growth this period with sales rising by 0.3% over the 12 weeks. Almost three-quarters of the population made a trip to Tesco in the past three months, helping the retailer to gain market share for the tenth month in a row and boost its proportion of the market by 0.6 percentage points to 27.6%.

While Lidl’s sales remained flat compared with last year, the discounter performed ahead of the market to nudge up its share by 0.1 percentage points to 6.2%. Aldi also increased its share of total grocery sales by 0.1 percentage points and it now holds 7.9% of the market.

Sainsbury’s, Asda, Morrisons, and Waitrose all lost market share, whilst Iceland’s and Ocado’s remained steady.

NAM Implications:

- “Already, (worried?) households visit an average of 3.3 supermarkets per month in order to find the best value for money.”

- Customers are also getting ahead on shopping for the big day itself.

- i.e. Frozen poultry sales are 27% higher year-on-year…

- With their sales rising by 0.3% over the 12 weeks, Tesco was the only retailer to achieve YoY growth!

- But note Lidl’s 12.5% increase on 2019….

- …and Ocado + 36.7% on 2019.