Tesco, Aldi, Lidl, and Ocado outperformed their rivals over the key Christmas period amid weaker overall sales than last year when Covid restrictions boosted demand in supermarkets to record levels. The market share data from Kantar showed consumers treated themselves during the festive season, but with more premium own-label ranges as inflation in the sector pushed up the cost of grocery shopping.

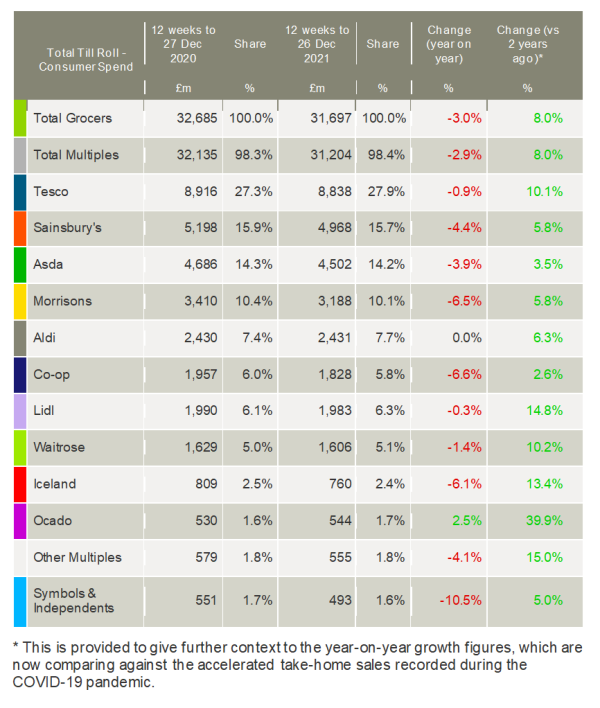

Total take-home grocery sales fell 3% year-on-year to £31.7bn over the 12 weeks to 26 December 2021. However, spending remained higher than it was pre-pandemic and sales were 8.0% stronger than in 2019 as people celebrated at home again due to Covid concerns.

Kantar highlighted that demand in supermarkets also picked up in December as people seized the chance to enjoy Christmas after last year’s muted festivities. Grocery sales hit £11.7bn over the month, down just 0.2% on record 2020 sales. “We can really see just how much spending accelerated in December compared with earlier in the year by looking at the average trend during March to November when sales were down by 2.5% against 2020,” said Fraser McKevitt, head of retail and consumer insight at Kantar.

Premium own-label sales broke records this Christmas and shoppers spent £627m on the supermarket’s upmarket lines over the four weeks to 26 December, an increase of 6.8% versus 2020. McKevitt commented: “The appetite to celebrate and splash out that little bit more this year pushed sales of luxury own-brand products up across the board. Sparkling and still wine sales grew 22% and 18% respectively, while crisps surged by 31%. Tesco’s Finest and Sainsbury’s Taste the Difference are easily the largest premium own-label ranges, but we saw the fastest growth from other ranges such as Asda Extra Special and Iceland Luxury.”

Alongside Christmas indulgence, rising prices also pushed up shopping budgets. Kantar’s data showed grocery price inflation reached 3.5% in December, adding nearly £15 to the average monthly grocery bill. “We saw prices rise faster for a short while in Spring 2020 when promotions were cut to maintain product availability, but before that, you would have to go back nearly four years to January 2018 to see inflation running higher,” said McKevitt.

Despite rising Covid-19 case numbers, online sales fell in December by 3.7% against 2020 as more people returned to shopping in-store. Online accounted for 12.2% of sales during the period.

Individual retailers found it challenging to secure year-on-year growth over the Christmas period following last year’s highs, but every major grocer increased sales compared with the final 12 weeks of 2019.

Ocado was the only retailer to buck the trend and grow versus last year, increasing its sales by 2.5% as it benefitted from increased distribution capacity and its joint venture with M&S.

Meanwhile, Tesco continued to gain market share, up by 0.6% to 27.9%, the highest it’s been since January 2018. Whilst its sales fell by 0.9% versus the same period in 2020, the retailer has benefitted from the success of its ‘Clubcard Prices’ promotion and ability to withstand supply chain disruption.

Sainsbury’s, Asda, and Morrisons all lost market share after Tesco, the discounters, and Waitrose made gains. Aldi’s share grew 0.3% after being the only chain not to record a fall in sales compared to last year as it continued its rapid store expansion.

Giles Hurley, Chief Executive Officer of Aldi UK and Ireland, commented: “Our market-leading Christmas performance showed customers were seasonally savvy, making sure they enjoyed the family Christmas they deserved after a difficult year by stocking up early and spending on luxury at low prices.”

The discounter revealed that its premium Specially Selected range notched up its highest ever sales, with it also seeing strong demand for its beers, wines and spirits.

Hurley added: “The top priority for most families this New Year will be managing their household budget in the face of rising living costs. As the cheapest supermarket in Britain, Aldi will always offer the lowest prices for groceries, no matter what, and continue to support our British farmers and producers.”

NAM Implications:

- Note Tesco Finest & Sainsbury’s Taste the Difference as premium O/L performers

- (particularly if you subscribe to the belief they are better than National Brands…)

- Also ‘grocery price inflation reached 3.5% in December’ as a rehearsal for Inflation-2022!

- …driving discounter share growth resulting from an inevitable discounter-driven price war.

- As always, key is how your Christmas sales compared, by format and category.