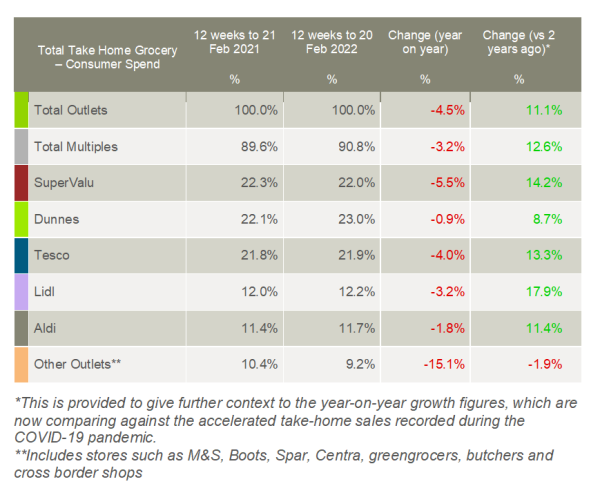

Latest figures from Kantar show that take-home grocery sales in Ireland fell by 4.5% over the 12 weeks to 20 February 2022 as Covid restrictions eased and people returned to offices and hospitality venues. However, spending remains 11.1% higher than before the pandemic.

The year-on-year drop in spending comes as grocery price inflation over the period hit 2.4%, marking the seventh consecutive month of accelerating inflation. The number of products sold on promotion fell by 10.9% year-on-year as retailers sought to manage mounting supply costs.

Emer Healy, senior retail analyst at Kantar, commented: “Prices are rising across the board and that’s really being felt at the grocery tills. We’re now starting to see this reflected in shopper behaviour, with people increasingly opting for private label lines over branded products in an attempt to drive down the cost of their weekly shop.”

Lidl, which has recently rolled out a new advertising campaign in Ireland pushing its ‘inflation buster’ prices, now holds a 12.2% share of the grocery market, up from 12.0% a year ago. The retailer was boosted by new shoppers who contributed an additional €4.1m to overall sales figures this period. Aldi also gained market share and now accounts for 11.7% of total sales.

Healy said: “Supermarkets have been quick to respond to growing concerns over the cost of living through targeted ad campaigns and voucher schemes. These kinds of tactics will only become more important as grocers battle for the biggest slice of consumer spend in a challenging environment.”

The adjustments to Covid restrictions across Ireland were again impacting how and where shoppers were buying their groceries, with online’s share of the market falling to 5.7% from 6.2% in February 2021. Healy commented: “Shoppers are returning to stores and getting less delivered, and we’ve seen a 15% drop in online grocery sales to the tune of €9.4m in the last four weeks as a result. Retailers have really invested in bolstering their online capabilities over the past couple of years and the proportion of groceries bought online has grown significantly since 2018. However, the growth of online grocery which we saw during the pandemic is now beginning to stabilise and has reached a natural ceiling as we ease back into life out of lockdown.”

All of the major retailers saw take-home grocery sales fall in the 12 weeks compared with last year, although they remained in growth compared with before the pandemic. Dunnes has retained its position as Ireland’s largest grocer this month, holding 23% of the market, while Tesco made a slight gain to 21.9%.

NAM Implications:

- The stand-out figures have to be Lidl’s 17.9% growth vs pre-pandemic performance.

- However, given the likelihood of Ukraine-scare replacing Covid-scare…

- …the future has to be about a price battle for market share.

- With Lidl and Aldi having sufficiently deep pockets (and global scale) to tolerate a local loss vs their operations in other countries…