Whilst many businesses in the UK will be impacted by continued supply chain disruption and the rising cost of living in the months ahead, analysts at GlobalData have suggested that retailers with younger or less affluent shoppers such as Asda or Morrisons will need to brace themselves for changes in shopping habits.

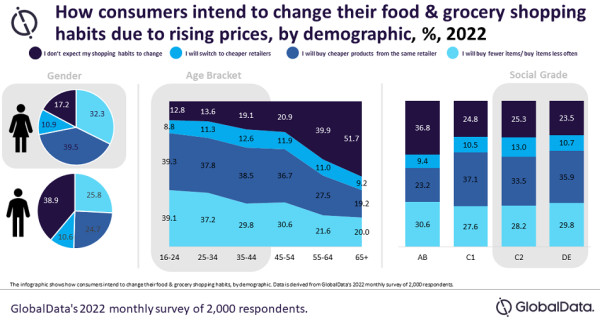

The company notes that because of price hikes many shoppers (32%) are trading down for cheaper products from the same retailer, while a slightly smaller proportion are simply buying less overall (29%). However, it noted that there is still a sizeable number (28%) of British consumers who do not expect any changes to their shopping habits in light of rising prices.

Amira Freyer-Elgendy, Food & Grocery Analyst at GlobalData, commented: “GlobalData’s research shows that women are more likely to take such budgeting measures, with less than two in five (17%) claiming that their shopping habits are unaffected by prices rises. This is in stark contrast to male respondents, which sees the response more than double to 39%.”

Compared to the other main grocery retailers, Asda attracts a younger audience and so the company is more likely to be affected by shoppers trading down, looking for the cheapest prices or cutting back on products overall.

Freyer-Elgendy added: “According to GlobalData’s 2022 monthly survey, young people tend to look for cheaper alternatives when money is tight, as they have less money saved up and are often less attached to familiar products. Comparatively, more than half of 65+ year old’s do not expect a change in shopping habits at all, but at the same time, they often have limited cash at their disposal and more moderate spending habits.”

Morrisons is also expected to be affected by consumer budgetary measures, as it is less likely than other retailers to see customers in the social grade AB.

Freyer-Elgendy said: “Asda and Morrisons have already recognised and addressed these concerns. To retain their shoppers, cultivate loyalty and soothe worries, the retail giants have recently promised to slash prices on essential items by 12-13% in order to cater to shoppers’ tightening budgets.”

Out of the top retailers, GlobalData believes that Sainsbury’s is likely to be the most unaffected, with a target audience that is older and a high prevalence of AB and C1 tier shoppers.

Freyer-Elgendy commented: “Sainsbury’s more premium reputation, however, could result in fewer loyal family shoppers, and so strategic schemes that demonstrate value for money, such as adding new lines to its Aldi price match scheme earlier this year and continuing to use an 8-week price lock scheme on selected products will help to prevent losing customers.”

NAM Implications:

- All now depends on quality of private label…

- …to ensure That Asda and Morrisons do not suffer unduly because of inevitable trading down.

- Preservation of shopper trust is key.