Latest industry data confirms that shoppers are increasingly turning towards discounters and value ranges in other supermarkets as the cost of living crisis worsens.

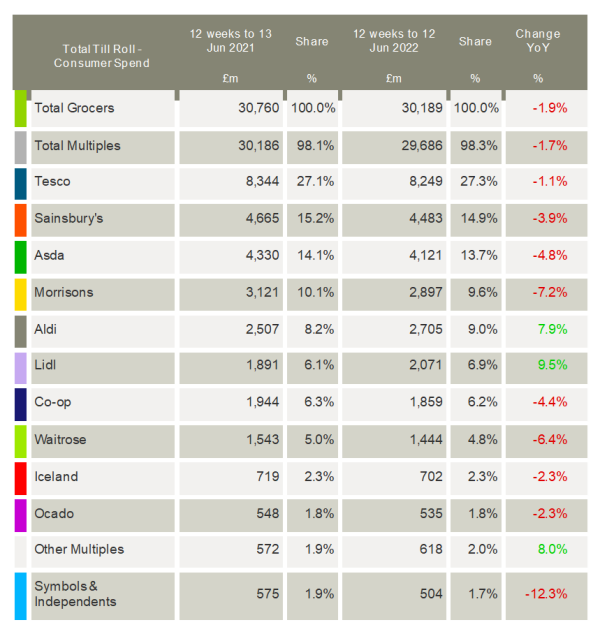

Take-home grocery figures from Kantar show overall supermarket sales fell by 1.9% during the 12 weeks to 12 June – the best market performance since October last year. This was bolstered by a 0.4% rise in the latest four weeks as consumers splashed out for the Platinum Jubilee, spending an extra £87m during the festivities.

Despite the more positive figures, inflation remained the key challenge for the sector and like-for-like grocery prices jumped 8.3% over the past month, up 1.3 percentage points on May to reach their highest level since April 2009.

“The sector hasn’t been in growth since April 2021 as it measures up against the record sales seen during the pandemic. However, these latest numbers show the market is to an extent returning to pre-Covid norms as we begin comparisons with post-lockdown times,” said Fraser McKevitt, head of retail and consumer insight at Kantar.

“The inflation number makes for difficult reading and shoppers will be watching budgets closely as the cost-of-living crisis takes its toll. Based on our latest data, the average annual grocery bill is on course to rise by £380. This is over £100 more than the number we reported in April this year, showing just how sharp price increases have been recently and the impact inflation is having on the sector.”

Analysis of the Kantar data shows that consumers are taking steps to manage rising prices at the tills. This includes shoppers swapping branded items, which have declined by 1.0%, for own-label products. Sales of these lines have risen by 2.9%, boosted by Aldi and Lidl’s strong performances, both of whom have extensive own-label repertoires. Kantar noted that consumers were also turning to value ranges, such as Asda Smart Price, Co-op Honest Value and Sainsbury’s Imperfectly Tasty, to save money, with all value own-label lines together growing by 12.0%.

Meanwhile, store footfall was up by 3.4% over the latest four weeks, while online fell to its lowest proportion of the market since May 2020 at 12.0%. McKevitt commented: “We’re still way ahead of our continental neighbours when it comes to buying groceries online, and one in five British households makes an order each month, the highest proportion in Europe. But online sales have been suffering since the end of the pandemic. This is the twelfth month in a row they’ve been in decline and digital orders fell by almost 9% in June.

“As well as the return to pre-Covidhabits, this drop could be the result of shoppers looking to cut costs by avoiding delivery charges. The sunnier weather may also be pushing up store footfall, as people decide it’s warm enough to walk or cycle to their local supermarket.”

Lidl was once again the fastest-growing grocer this period, with its sales up by 9.5% over the 12 weeks to reach a market share of 6.9%. Sales at Aldi rose by 7.9%, moving its share up versus last year by 0.8 percentage points to 9.0%.

While it didn’t achieve year-on-year growth, Tesco outperformed the total market to nudge its share up to 27.3%. Sainsbury’s (14.9%), Asda (13.7%) and Morrisons (9.6%) all lost market share, as did the Co-op (6.2%) and Waitrose (4.8%).

However, Iceland held its market share at 2.3%. This was supported by its new 10% discount offer for over 60s, with the deal helping nearly double its market share among that demographic on Tuesdays over the past month.

NAM Implications:

- Standout point – combined shares of Aldi & Lidl (15.9%) now second only to Tesco 27.3%.

- (Begging question: What % share of your business do they represent?)

- Aldi & Lidl growing at 7.9% and 9.5% respectively…

- …compared with falling sales of other mults.

- Meanwhile, inflation surges thru the pipeline.

- i.e. average annual grocery bill is on course to rise by £380, £100 more than April…

- …and more to come.

- In these market conditions, shoppers are buying own-label and value lines…

- …at the expense of brands.