Latest industry data confirms that the discounters are continuing to gain market share as grocery price inflation accelerates, with Aldi now the UK’s fourth-largest supermarket chain after overtaking a poorly performing Morrisons.

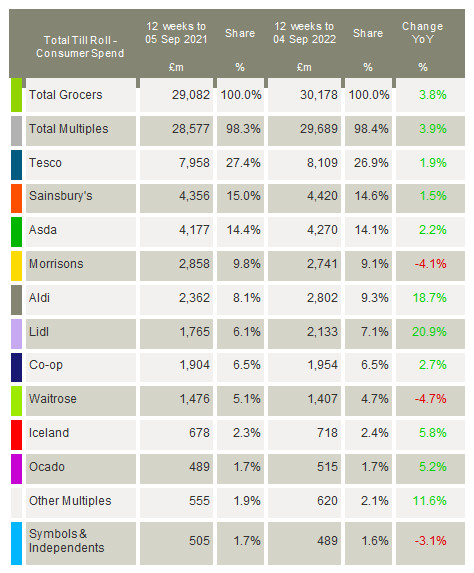

The Kantar figures show that take-home grocery sales increased by 3.8% in the 12 weeks to 4 September 2022, driven partly by grocery price inflation that hit a record 12.4% during the past month.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “It seems there’s no end in sight to grocery inflation as the rate at which food and drink prices are increasing continues to accelerate. Now standing at 12.4% for August, the latest figure means that the average annual grocery bill will go from £4,610 to £5,181 if consumers don’t make changes to what they buy and how they shop to cut costs.”

Categories like milk, butter and dog food are seeing some of the biggest price increases, with average inflation at 31%, 25% and 29% respectively.

McKevitt added: “In what is a fiercely competitive sector, supermarkets are reacting to make sure they’re seen to acknowledge the challenges consumers are facing and offer best value, in particular by expanding their own-label ranges. Their efforts seem to be well received by consumers, with sales of the very cheapest value own-label products up by 33% this period versus a year ago and nearly one in four baskets containing one of these lines. Overall spending on all retailer own-label lines was £393m higher during the latest four weeks, pushing own-label’s share of the market to 51.1%.”

As part of steps to manage their budgets, shoppers appear to be broadening the range of stores they visit, with the discount grocers benefiting the most. Aldi’s sales rose by 18.7% over the 12 weeks, driving its market share to 9.3% and making it Britain’s fourth largest supermarket for the first time. Meanwhile, Lidl’s sales jumped 20.9%, with its market share increasing to 7.1%.

McKevitt said: “Back at the start of the 2010s, Tesco, Sainsbury’s, Asda and Morrisons together accounted for over three-quarters of the sector, but that traditional big four is no more.

“The discounters have seen dramatic sales increases in recent months, bringing more and more customers through their doors. Aldi has done well to expand its shopper base, supported by consistent store openings, and with 14.2 million consumers visiting the grocer in the past three months. Meanwhile, for the fourth month in a row Lidl was the fastest growing grocer and recorded its strongest sales performance since October 2014.”

Tesco, Sainsbury’s and Asda all achieved their best sales performance since April 2021 (see below). However, all three lost market share, as did Morrisons after its sales slid 4.1%.

Waitrose again saw the biggest fall in sales, down 4.7%, a sign that the upmarket grocer may suffer as more people switch to value-orientated retailers amid inflation and soaring energy prices.

Meanwhile, Iceland’s focus on value helped it win market share in the latest period and its sales were 5.8% higher than in 2021. Co-op held its market share at 6.5% while securing a 2.7% increase in sales.

NAM Implications:

- Given 12.4% inflation and Winter costs not yet here…

- …anticipating that consumers WILL “make changes to what they buy and how they shop to cut costs” becomes a no-brainer.

- Also, best factor in the inevitability that Aldi & Lidl will be significant beneficiaries of these changes in shopping behaviour…

- …given their current growth rates vs other retailers.

- Despite any attempts made by Morrisons to claw back the No. 4 position…