Latest figures from Kantar show that take-home grocery sales in Ireland increased by 3.6% in the 12 weeks to 3 October 2022, as price inflation in the sector hit a record high of 12.4%.

The report noted an average 8.6% increase in price per pack saw shoppers spend an additional €99.1m compared to the same period last year, while the number of shopping trips increased by 3.8%. Over the last four weeks, the average price per pack increased by 8.7%. Kantar stated that the rising cost of everyday essentials is hitting shoppers particularly hard, with the average price of staples like butter, milk and bread now 28% higher than this time last year.

Emer Healy, Senior Retail Analyst at Kantar, commented: “Grocery price inflation is the highest level seen since Kantar started tracking the data. As food and drink prices continue to climb alongside other financial pressures, 32% of shoppers in Ireland admit they are ‘struggling’ to make ends meet, a figure that has increased from 23% in March of this year.

“The average annual grocery bill will go from €6,999 to €7,867 if consumers don’t make any changes to what they buy and how they shop to cut costs. This means the average annual shop is set to rise by €868 a year. At a basket level, that’s an extra €3.36 per trip.”

As consumers change their shopping behaviour to save money, supermarket own-label ranges continue to benefit. Sales of retailer own-label lines jumped 7.2% in the 12-week period with shoppers spending an additional €88.3m year-on-year. Value own-label ranges saw the strongest growth, up 23.5% with shoppers spending an additional €11.3m.

Meanwhile, online sales saw a decline for the first time since March 2022, with shoppers making trips to physical stores instead (+5.5%). In the last four weeks, online visits were down 3% and volumes fell by 6.4%, with 1.8% of shoppers leaving the online channel in October.

Despite household budgets tightening, the data suggests that shoppers are still looking for small luxuries to enjoy at home. As a result, sales of branded take-home soft drinks, chocolate biscuit bars and crisps jumped 5.4%, 10.9% and 6.5% respectively over the 12 weeks. Overall, branded goods saw slight growth in the same period, up 0.7% with shoppers spending an additional €9.2m.

Kantar noted that retailers in Ireland continue to respond to consumer demand for value with loyalty card or voucher offers, and increased emphasis on own-label ranges.

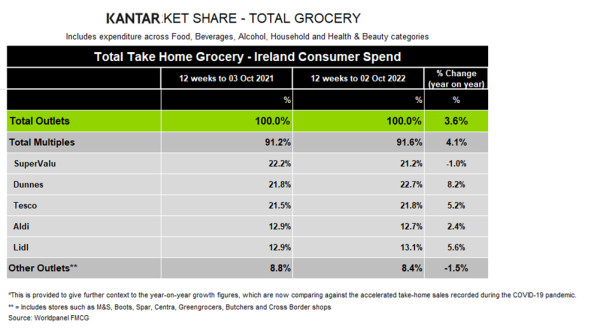

Dunnes still has the highest share in the Irish grocery market at 22.7% after seeing sales growth of 8.2% year-on-year. This growth stems from an influx of new shoppers, up 5.3%, which contributed an additional €32.3m to their performance.

Tesco holds 21.8% of the market with growth of 5.2% thanks to an 8.9% increase in shoppers returning to stores more often. SuperValu holds 21.2% of the market and continues to see shoppers make the most trips in-store when compared to all retailers, with an average of 21.2 trips per year, up 3.5% year-on-year.

In contrast to the UK, the discounters aren’t performing as strongly in Ireland. Lidl still saw robust growth of 5.6% as new shoppers contributed an additional €11.8m to their performance. However, Aldi’s growth was just 2.4% year-on-year, compared to a recent rise of 20.7% in the UK.

NAM Implications:

- A key issue has to be the extent to which consumers will revert to former shopping behaviour…

- ..when/if things revert to the Old Norm?

- Add the fact that mortgage interest rates in Ireland were 2x EU average before the current burst of inflation…

- …there have to be limits when ‘the average annual shop is set to rise by €868 a year’.

- Own Label was always a slow burn in Ireland, so ‘sales of retailer own-label lines jumped 7.2%’ is significant.

- Discounters experiencing unprecedented growth in the UK are likely to try harder in Ireland…

- …especially as Aldi & Lidl are parts of global retailers larger than Tesco.

- i.e. they could afford to subsidise Irish operations (whatever it takes, if necessary…)

- Watch this space…