Kantar’s latest data shows take-home grocery sales in Ireland increased by 11.3% in the four weeks to 14 May, with higher prices the driving force as opposed to increased purchasing. Grocery inflation was running at 16.5% over the longer 12-week comparison, down by only 0.1% on the previous reading.

Emer Healy, Senior Retail Analyst at Kantar, commented: “The slight drop in grocery price inflation is without doubt welcome news for shoppers but it is still high – 16.5% is the third fastest rate of grocery inflation we’ve seen since 2008. In response to the high level of inflation, we are seeing consumers change their shopping patterns to off-set part of the increased cost”.

Shoppers are turning to shopping little and often to help manage household budgets. The latest 12 weeks showed that shoppers returned to stores more often, with visits up by 12%, equating to an additional 7 trips. This contributed an additional €574m to the overall market performance alongside a significant increase in the average price per pack, which is up 13.7% year-on-year.

Kantar highlighted that the market is seeing much stronger own-label growth (16.3%) compared to branded (8.2%) as shoppers continue to look for ways to save money. However, it was value own-label that saw the strongest growth year-on-year at 32.3%, with shoppers spending €17.5m more on these ranges.

May also marked the first time that branded and own-label were on equal terms when it comes to market share, with each holding a 47.3% share of the market, a sign that the hunt for the best value in the market continues.

Online sales remained positive, up 3.3% year-on-year, with shoppers spending an additional €5.3m online. However, volume sales online were down 16.3% compared to last year.

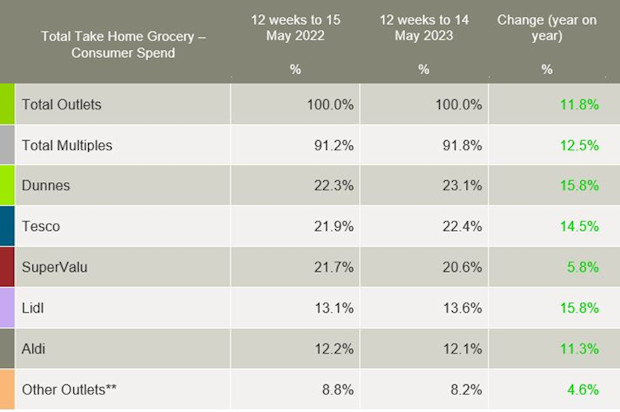

Dunnes, Tesco and Lidl experienced value growth ahead of the total market in May. Dunnes held the highest share amongst all retailers at 23.1%, with growth of 15.8% year-on-year which stems from shoppers returning to stores 14% more often, equating to nearly two additional trips.

Tesco held 22.4% of the market after recording 14.5% growth. It saw the strongest frequency growth amongst all retailers of 16% year-on-year, contributing an additional €93.7m to its overall performance.

SuperValu held 20.6% of the market and saw growth of 5.8%. SuperValu shoppers made the most trips in store compared to all retailers, with an average of 23.8 trips, an increase of 15.4% year-on-year.

Lidl hit a record new share of 13.6% share after seeing growth of 15.8% year-on-year. More frequent trips contributed to an additional €44.4m to their overall performance. Aldi held 12.1%, having grown 11.3%. A strong boost in new shoppers and more frequent trips contributed an additional €53.2m to its overall performance.

NAM Implications:

- Shopping little & often means less wastage…

- And brand vs O/L at 50/50 could represent a ‘permanent’ change.

- And a combined discounter share of 25.7% (i.e. more than Tesco)

- Has to be a concern for rivals.

- And those suppliers still seeking ways into Aldi & Lidl…