With Amazon’s annual Prime Day sale getting underway today, a senior retail analyst at GlobalData has suggested that the e-commerce giant must provide a compelling promotional event to halt a decline in participation by UK consumers.

Eleanor Simpson-Gould stated that Amazon needs to offer “unmissable deals on top brands to stand out among the many retailers already advertising a plethora of discounts.”

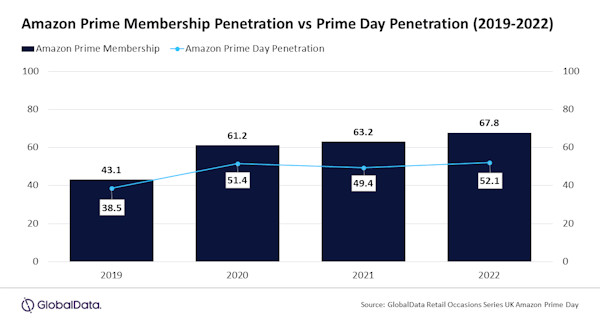

A survey by GlobalData showed that the proportion of consumers with access to Prime membership has been accelerating since 2019, up 24.7ppts to reach 67.8% in 2022. However, the proportion of consumers reporting that they bought something during Amazon Prime Day has not kept pace, with participation only rising 13.6ppts over the same period.

Consumer sentiment regarding retail spending has shown early signs of improvement, with GlobalData Retail’s retail spend index, which is calculated as respondents that expect to spend more minus the proportion of those that expect to spend less on retail over the next six months, up 1.4 points to -61.1 in June compared to May. Yet, with the online non-food market forecast to experience only modest growth of 0.4% in 2023, GlobalData noted that online pureplay will have a challenging time encouraging shoppers to part with their cash.

Simpson-Gould concluded: “As the UK’s inflationary hangover will be slow to ease, Prime Day discounts will be scrutinised with a finer lens than ever before. Amazon’s purchasing power must come into play to secure deeper discounts than competitors. Homewares & furniture discounts should be a focus for Amazon due to the largest spend in these categories attributed to 35-44 year olds, who made up the largest age profile for UK Prime Day shoppers in 2022 at 26.8%. Coupled with the improving optimism regarding spending ability seen by this cohort in June, this group is a key target for promotions.”

Related item:

See the results of Martin Heubel’s recent survey among his LinkedIn network about their margin projections for Amazon’s Prime Day event – view here

NAM Implications:

- This could be about cash-strapped canny consumers willing but unable to purchase big-ticket items…

- …added to economic and political uncertainty leading to postponed gratification.

- And Amazon’s undoubted pulling power not being sufficient to mark a difference…