Latest data from Kantar confirms that grocery inflation in Ireland has fallen to a new low for this year, with further declines expected as cost pressures continue to ease. The figure fell to 14.7% in the 12 weeks to 9 July, down from last month’s 15.8%.

Over a shorter four-week period, the research shows that the average price per pack increased by 11.1%, driving up the value of take-home grocery sales by 9.6%.

Emer Healy, Business Development Director at Kantar, commented: “This is the second month in a row there has been a drop in inflation, which is welcome news for shoppers.” Although the rate is still high, she noted that there is likely to be a gradual decline over the coming months.

The Irish market continues to see stronger own-label growth (+13.3%) compared to brands (+7.6%) as shoppers look to save money. Value own-label saw the strongest growth year-on-year at 26.3%, with shoppers spending €14.2m more on these ranges.

However, according to Kantar’s latest Brand Footprint report, shoppers in Ireland still value home-grown brands, with four out of the top five most chosen brands chosen being Irish. The average Irish household buys 81 different food and drink brands in a year, showing just how important brands are for consumers.

Meanwhile, Kantar noted that shoppers visited stores more often, making on average one additional trip compared to the same period last year. Healy said: “While shoppers are returning to store more often, they are picking up less volume per trip, while there has also been more out-of-home dining during summer”.

Online sales also remained strong over the 12 weeks, up 6% year-on-year, with shoppers spending an additional €9m in the channel, a significant boost on June’s increase of €3.5m. More frequent trips online boosted its performance, contributing an additional €8.5m.

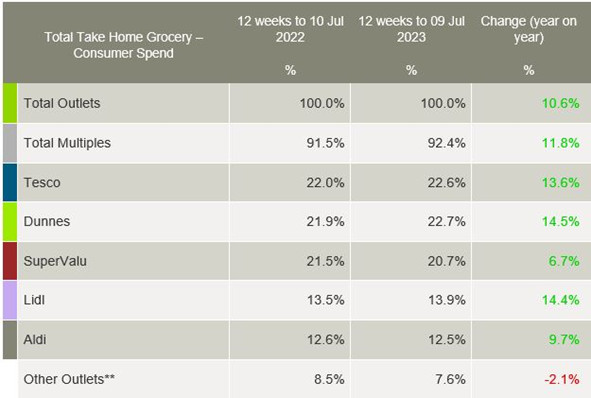

For another month in a row, Dunnes, Tesco and Lidl all grew ahead of the total market in terms of value this month. The gap between the retailers is closing as it becomes more competitive for the highest share. Just 0.1% separated Dunnes and Tesco, similar to a situation between the two retailers last August.

Dunnes held the highest share amongst all retailers at 22.7%, with growth of 14.5%. This growth is down to shoppers returning to store more often (+2.9% year-on-year), together with a 2.6 percentage points increase in new shoppers in-store.

Tesco controlled 22.6% of the market, with growth of 13.6%. Tesco had the strongest frequency growth amongst all retailers, up 18.4% year-on-year, contributing an additional €106.1m to overall performance along with a 0.3 percentage points increase in new shoppers in-store.

SuperValu held 20.7% of the market after seeing growth of 6.7%. SuperValu shoppers made the most trips in-store when compared to all of the retailers, an average of 23.5 trips, which is up 12% compared to the same time last year.

Lidl hit a new record share of 13.9%, with growth of 14.4%. More frequent trips contributed to an additional €47.2m to overall performance. With strong market growth, Kantar noted that Lidl holds the potential to hit 14% market share by the end of the summer.

Aldi’s share edged down to 12.5% after seeing growth of 9.7% year-on-year. More frequent trips contributed an additional €41.6m to its overall performance.

NAM Impplications:

- Key standouts appear to be the continuing threat of the discounters.

- This coupled with the trend towards more consumption of value own-label…

- …appear to support the combined market share of Aldi & Lidl producing 26.4% share of grocery retail.