Latest data released by NIQ shows Total Till sales in UK supermarkets rose 9.1% during the four weeks ending 7 October, slightly down from the 10.1% growth recorded in the previous month and almost in line with food inflation (+9.9%). However, volume sales continued to improve, with a decline of only 0.4% as shoppers took advantage of price cuts and discounts offered by supermarket loyalty schemes.

Visits to stores were up only 1.6% as the back-to-school period led shoppers to return to their usual shopping patterns. As a result, there was a slight boost to online grocery sales, with the channel’s market share returning to 11% of FMCG sales in the period.

Warm weather towards the end of September and early October helped some seasonal categories achieve an uplift in sales. The NIQ data shows that shoppers purchased more fruit, vegetables and salads, with the category seeing volume sales increase by 3.6%.

Meanwhile, some categories continued to feel the effects of inflation, with confectionery value sales increasing 12%, followed by frozen (+9.1%) and crisps and snacks (+9.0%). Beer, Wine and Spirits continued to have the lowest FMCG sales growth, up just 2.2%. However, there was an uptick in sales for beer and cider (+8.8%), and in particular stout (+19.2%), which was likely due to consumers purchasing drinks to watch the Rugby World Cup.

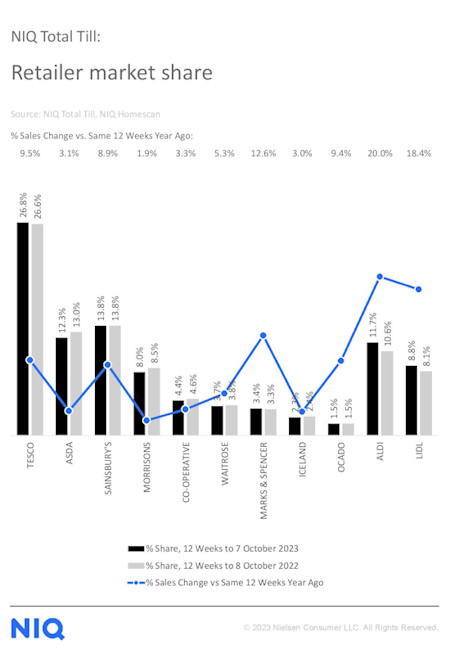

In terms of retailer performance, Aldi and Lidl remained the fastest growing retailers over the latest 12-week period, although sales remained strong at Tesco (+9.5%) and Sainsbury’s (+8.9%), with both retailers having more visits than the same time last year. M&S (+12.6%) also continued its strong growth, boosted by the warm weather.

Ocado grew 9.4%, with Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, commenting: “Our latest data indicates that the online grocery channel is back into sustainable growth, with sales up 7.3% over 12 weeks. Ocado has grown market share of the online channel, helped by increased marketing activity and the investment in price matching against Tesco, including promotions and Clubcard prices. These seems to be resonating well with shoppers.”

Watkins concluded: “There has been an improvement in volumes purchased over the last four weeks. This is a reflection that this time last year the pressure was growing on household incomes as inflation was accelerating in fuel, energy, and food. But it may also be an indication that some shoppers are now feeling more confident about their personal finances. If so, this would help sustain growth over the forthcoming half-term period and may give a further boost in early November as seasonal advertising campaigns start.”

NAM Implications:

- The standout results are ‘slight’…

- …meaning any real growth has to come at the expense of rivals.

- In which case, a realistic evaluation of relative competitive appeal is crucial.

- Meanwhile, the combined discounter share of 20.5% has to be a cause of concern for rivals…

- …and an opportunity for suppliers that find a way in.