By Accuris, providers of analytics for promotions, pricing and revenue management

The latest findings from the Accuris Promotion Effectiveness Benchmark indicate that Sainsbury’s presents the most effective environment for brand promotions, evidenced by the industry’s highest uplift percentages. However, this raises a pertinent question: does this advantage primarily benefit Sainsbury’s, or is it the brands that are reaping the greater rewards?

2023: A Pivotal Year in Sainsbury’s Promotional Strategy

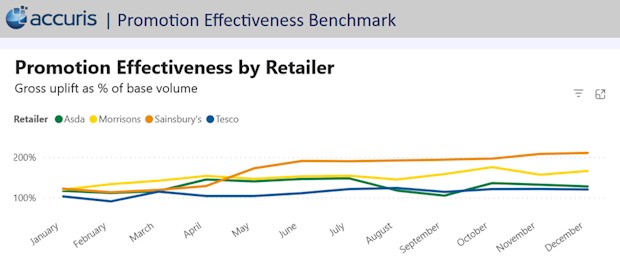

The launch of Nectar Prices in 2023 marked a significant milestone for Sainsbury’s, propelling it ahead of its three main competitors – Tesco, Asda, and Morrisons – in terms of promotion effectiveness. From May onwards, Sainsbury’s witnessed a notable surge in sales uplifts, attributing this success to its relaunched loyalty programme. However, it appears that the primary beneficiaries of these promotions were the brands themselves, rather than Sainsbury’s market share.

Since May 2023, promotional sales uplifts have been consistently higher at Sainsbury’s than at Morrisons, Asda or Tesco.

Brand Success vs. Market Share: A Sainsbury’s Conundrum

At Sainsbury’s, brands have found an effective platform to vie for market share among themselves, more so than at any other retailer. Yet, the influence of these promotions in drawing shoppers to Sainsbury’s stores or boosting overall category consumption has been comparatively limited. Despite the success of the Nectar Prices programme for participating brands, Sainsbury’s own market share experienced a decline, dropping from approximately 15.1% in March (pre-launch) to 14.7% by September, as reported by Kantar.

The Varied Impacts of In-Store Promotions

In-store promotions can lead to a multitude of consumer behaviours, including brand switching, increased spending, and store switching for better deals. However, the goals of retailers and brands can often diverge. For instance, Sainsbury’s does not necessarily gain market share if sales shift from Pepsi to Coca-Cola within its stores. Similarly, a brand like Coca-Cola does not increase its market share if it’s merely shifting consumer purchases from Tesco to Sainsbury’s. According to the Accuris Source of Business model, the rise in Sainsbury’s promotional effectiveness is primarily attributed to customers switching between brands within Sainsbury’s, rather than shifting their shopping from other retailers to Sainsbury’s.

Tesco Leads in Retail Switching

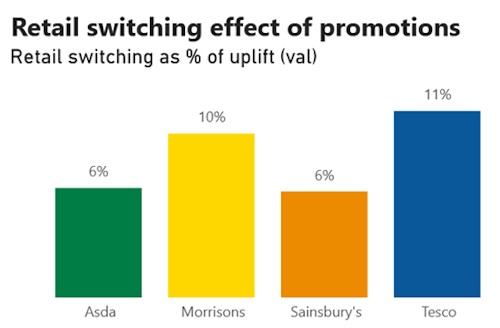

In comparison, Tesco leads in inducing retail switching through promotions, with 11% of incremental spending resulting from this effect – almost double that of Sainsbury’s. Key categories showing strong retail switching effects include baby products, health & beauty, and non-alcoholic beverages, where Sainsbury’s notably lags behind, especially in baby products. The retailer also lags in fostering retail switching through promotions in categories such as household products, beer, wine, spirits, and even fresh food. While Sainsbury’s has achieved notable retail switching with promotions for brands like Pampers, Persil, and Casillero del Diablo, it has not capitalised sufficiently on baby product promotions. Moreover, compared to Tesco, Sainsbury’s has been less effective in promoting some of the essential “hero” brands.

Nectar Pay Day Savings: A New Strategy

Sainsbury’s recent “Nectar Pay Day Savings” initiative, offering half-price deals on selected products from brands such as Lurpak, Cathedral City, and Innocent, might enhance its retail switching appeal. However, retail switching typically sees a significant boost when promotions involve strong, market-leading leading brands. As of this writing, none of the top 20 brands have been featured in Sainsbury’s Half Price Pay Day deals.

Reflections and Prospects

The increased promotional effectiveness within Sainsbury’s stores, courtesy of the Nectar Prices, while not translating into market share growth, aligns with its nature as a loyalty program rather than a shopper recruitment tool. With a more insightful selection of product categories and the inclusion of additional promotions for leading brands, the Nectar Prices programme has the potential to enhance retail switching and possibly contribute to market share gains for Sainsbury’s in 2024.

For more details on the Accuris promotion benchmark, click here

NAM Implications:

- A clear case of supplier know your product!

- i.e. clearly some brands drive sales via Sainsbury’s promos…

- …others drive Sainsbury’s market share.

- It seems obvious that suppliers that build these differences into their brand strategies will optimise their Sainsbury’s relationship.

- Over to you…