The Irish grocery market received a boost in the run-up to Easter, according to new figures from Kantar.

For the four weeks to 17 March 2024, take-home grocery sales rose 4.5% to €1.1bn, helped by a 4% rise in the average price per pack, which offset a 1.2% dip in volumes per trip.

However, Kantar noted that grocery price inflation was the main factor behind the rise in value sales, with grocery inflation up 3.7% in the 12 weeks to 17 March 2024, which is down a significant 16% versus March 2023.

Emer Healy, Business Development Director at Kantar, said: “This is the eleventh month in a row that there’s been a drop in inflation, which will be very welcome news for consumers. While it’s the lowest inflation level we have seen for two years, shoppers in Ireland are still on the hunt for value with over 25% of value sales coming from promotions.”

During the period, nearly half of all Irish households purchased Easter eggs, up 13.1 percentage points versus last year. Shoppers spent €24.6m on Easter Eggs, an additional €9.3m versus last year. However, many also opted for other popular Easter treats, with sales of hot cross buns up 28% year-on-year to €1.1m.

Retailers also bumped up promotional activity during Easter with over 51% of value sales of Easter eggs sold on promotion. Sales of own label performed strongly, growing ahead of the total market at 5.5% year-on-year and holding value share of 48%, with shoppers spending an additional €80.5m year-on-year.

Premium own label ranges continued to perform well with shoppers spending an additional €172m on these lines (+12.3% year-on-year). Brands also saw growth over the 12 weeks of 3.8%, slightly behind the total market. Online sales were up 16.7% year-on-year with shoppers spending an additional €26.5m online year-on-year. New shoppers, alongside larger trips, boosted online’s overall performance by €16.3m.

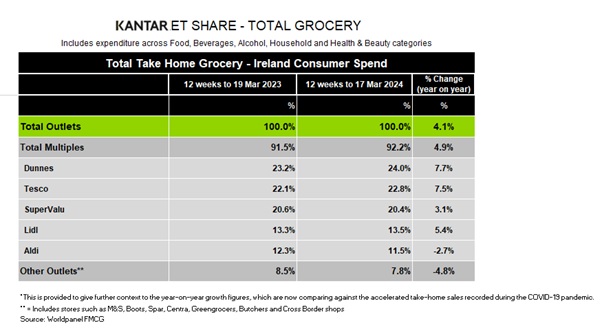

Amongst retailers, Dunnes held a 24% market share with growth of 7.7% year-on-year. The growth was boosted a 5.4% rise in supermarket visits, which contributed an additional €38.2m to overall performance.

Amongst retailers, Dunnes held a 24% market share with growth of 7.7% year-on-year. The growth was boosted a 5.4% rise in supermarket visits, which contributed an additional €38.2m to overall performance.

Tesco holds 22.8% of the market, up 7.5% year-on-year, and had the strongest frequency growth amongst all the retailers for another month in a row, which contributed an additional €50.8m to the overall performance.

SuperValu holds 20.4% of the market with growth of 3.1%. SuperValu shoppers make the most trips in-store when compared to all retailers (21.3 trips on average) and a boost in volume per trip, which contributed an additional €12.4m to the overall performance.

Lidl holds 13.5% share with growth of 5.4% year-on-year. More frequent trips contributed an additional €30.9m to its overall performance. Aldi holds 11.5% market share with more frequent trips contributing an additional €6.4m to the overall performance.

NAM Implications:

- Key standout has to be Aldi+Lidl combined share of 25%…

- i.e. ‘market leader’ vs Dunnes 24%…

- Meanwhile, over 51% of Easter Eggs value sales sold on promotion…

- (negating some of the price increases?)