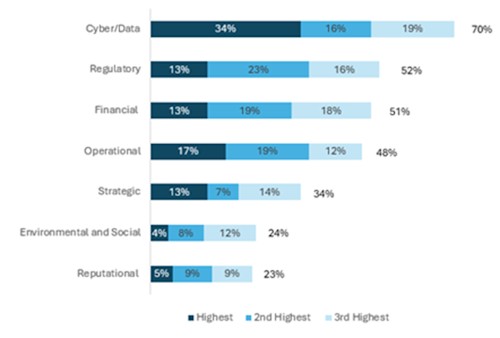

Barclays Corporate Banking and economics research consultancy Retail Economics have revealed research showing that cyber and data threats are viewed as the biggest risks by over a third (34%) of UK retailers surveyed, with 70% saying they form part of their top three risks over the next 12 months.

The study notes that this area is vital to address as retailers today are dependent on a range of technology to give their customers seamless access to products and services, and to perform basic operating functions.

The second-largest perceived risk is related to a more complex regulatory environment (52%), which includes additional friction around international trade and more uncertainty around future environmental policy.

Financial (51%) concerns were also cited in the top three, reflecting higher interest rates that have impacted financing costs, not just for retailers, but throughout supply chains, as well as impacting businesses in financing production.

Seven key pillars of risk

The research identifies seven key pillars of risk facing UK retail businesses today and quantifies retailers’ perceptions about levels of risk, confidence in mitigating challenges, and their preparedness in dealing with risks relative to their competition.

Perceived level of risk across resilience pillars

Source: Barclays Corporate Banking and Retail Economics

Source: Barclays Corporate Banking and Retail Economics

While retailers are most concerned about cyber and data threats, they also feel most confident in managing them, having invested in technology to safeguard their operations. In fact, the vast majority of retailers (81%) feel that they are either “where they needed to be” or “ahead” of the competition regarding cyber security issues such as ransomware, malware attacks, network security or fraudulent attempts to obtain sensitive information.

Retailers feel least confident about future ‘environmental and social’ risks

While ‘environmental and social’ concerns were perceived as one of the lowest risks over the next 12 months (ranked six out of seven), it is an area where retailers feel least confident in mitigating. However, this risk was ranked highest by retailers surveyed when asked to identify which risks were most likely to rise in the next five years.

Karen Johnson, Head of Retail and Wholesale at Barclays, commented: “Part of the solution here is likely to stem from cross-industry partnerships between retailers and corporate organisations for instance in supporting climate tech startups and financing carbon reduction initiatives.”

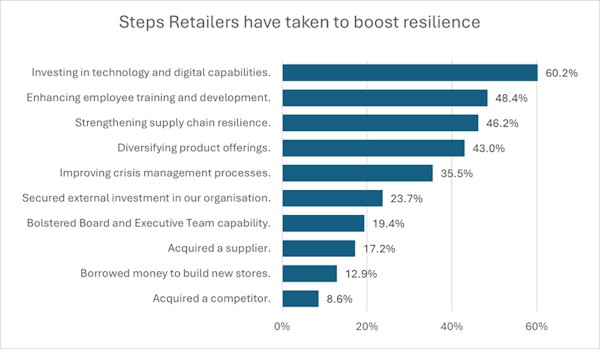

Investing in resilience

To help ensure long-term resilience, the research identified the top five actions taken by retailers as: (1) investing in technology; (2) enhancing employee training and development; (3) strengthening supply chains; (4) diversifying product offerings; and (5) improving crisis management processes.

Source: Barclays Corporate Banking and Retail Economics

Johnson commented: “Investing in technology is a critical component of building a resilient, future-proof business model for retailers. There’s a clear recognition of needing to invest in people, build strong supply chains, and improve crisis management capabilities in an increasingly uncertain geo-political environment”.

Indeed, investing in technology and digital capabilities is at the forefront of resilience today, with 60.2% of retailers citing this as their top priority.

Furthermore, almost half (48.4%) of retail leaders surveyed said they have taken steps to enhance employee training and development. This focus on people was seen to not only boost operational efficiency, but also foster a culture of innovation, agility and leadership.

Disruption caused by the pandemic and geopolitics has put supply chains in the spotlight. Here, 46.2% of retailers surveyed have invested in strengthening their supply networks, often by diversifying, investing in local sourcing, and utilising technology for real-time supply chain monitoring.

GenAI: risk or opportunity?

The research also revealed mixed views over whether GenAI is perceived more as a risk than an opportunity, with retailers surveyed showing a polarised view.

Interestingly, opinions were broadly balanced with 41% viewing GenAI more as an opportunity, 37% as a risk, and 23% saying it was too early to tell, or weren’t confident enough to suggest which direction it was likely to take.

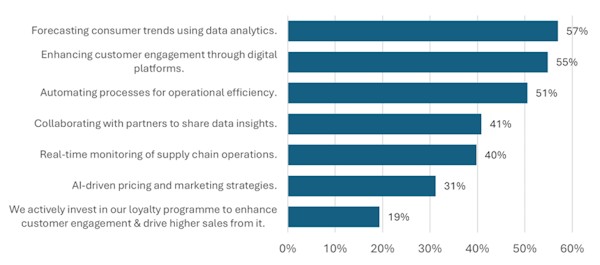

Johnson said: “The focus on operational efficiencies is a reflection of the current economic environment with a squeeze on margins placing an urgency on implementing cost-saving solutions”.

The research also showed that retail leaders surveyed mainly view leveraging technology investment as a way to improve efficiency and automation (51%), rather than boosting customer loyalty (19%).

Retail leaders view GenAI more as an opportunity than a risk

Source: Barclays Corporate Banking, Retail Economics

Richard Lim, CEO of Retail Economics, concluded: “The retail industry continues to face successive waves of disruption. In just the last few years, businesses have emerged from a global pandemic to face the worst cost of living crisis for a generation, all while technology has evolved at an astonishing pace. GenAI is the new buzzword in the industry, but many are struggling to grapple with what this means for their business and the future.

“It’s a huge credit to those who have continued to thrive, and it shows a resilient industry built on solid foundations. However, this should not be taken for granted. While retailers may feel prepared to tackle today’s rising threat of cybercrime, they need to remain alert, and seize the many opportunities emerging on the horizon.”