Total Till data from NIQ shows that sales in UK supermarkets grew 5.5% over the four weeks to 10 August, up from a 3.6% rise in the previous month and the strongest growth so far this year.

Sales were boosted by the short heatwave in the week to 3 August, when growth hit 6.6%. Moreover, as Euro 2024 ended, retailers continued to entice shoppers by offering more price cuts and maintaining promotional spend at 25% of sales purchased. Waning food price inflation also helped lift demand, falling to 2.3%

The NIQ data also showed that the online channel performed well last month, with sales up 6.8%, outpacing in-store growth of 3.8%. Online’s share of FMCG spend grew to 12.8% – up from 12.5% this time last year.

Across all supermarkets, visits to stores increased by 2.7% and online occasions (orders) jumped by 10.5%. Sales in the convenience channel also picked up after a poor 2024 so far, with 4.8% growth.

With the return of warmer weather leading to alfresco dining, the value sales of Produce improved 11.8% (unit growth +6.5%), while Soft Drinks were the fastest growing supercategory at 14.3% (unit growth +10.4%). Sales of BWS also recovered with value growth of 5.4% (unit growth +4.7%).

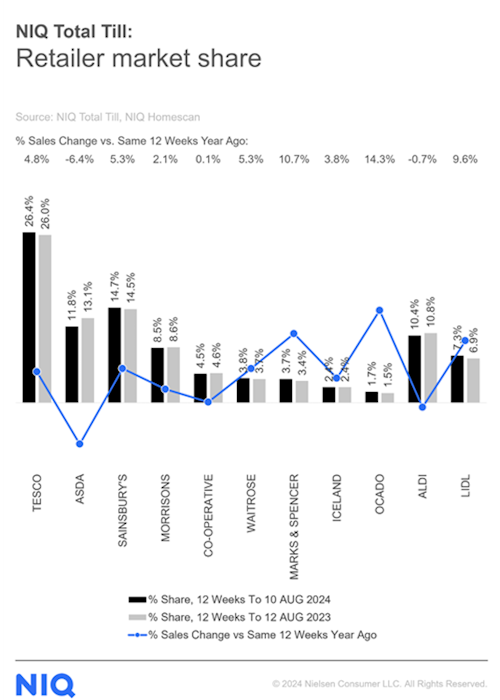

In terms of retailer performance over the 12 weeks to 10 August, M&S (+10.7%) and Ocado (+14.3%) were still the fastest-growing grocery retailers. Both also experienced significant growth over the last four weeks as households shopped more often for summer indulgences.

Sainsbury’s and Tesco continued their strong runs, whilst it was another disappointing period for Asda, with sales sliding 6.4%.

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, said: “Retailers will be pleased to have maintained shopper spend beyond Euro 2024, with the warm summer weather adding a boost to sales. However, with almost 1 in 3 household`s (29%) top concern still being inflation and shoppers still looking for value, it’s clear that loyalty and membership schemes remain key to encourage spend.”

He added: “As summer draws to a close, retailers will be under pressure to maintain sales growth in the next six weeks. This is especially true with the lack of seasonal events and the back-to-school period as shoppers settle into new routines. We can also expect more comparative price advertising by retailers as they reinforce price credentials ahead of the all-important Q4 sales build.”