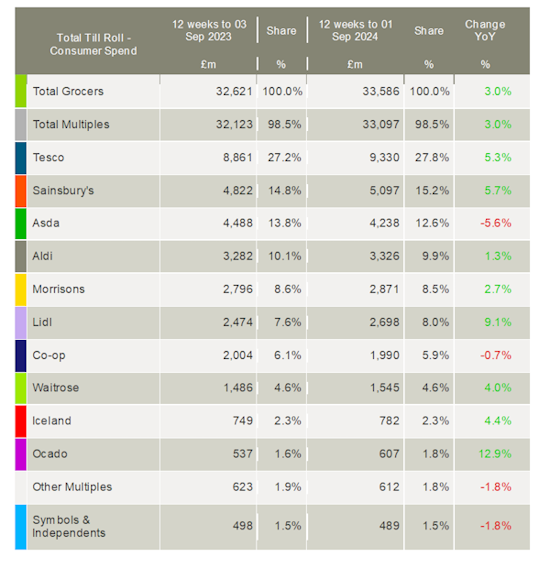

Latest Kantar data shows that take-home sales at the leading UK grocers rose by 3.0% over the four weeks to 1 September, with grocery price inflation easing back to 1.7%, having edged up to 1.8% last month.

Ocado was the fastest-growing grocer for the seventh consecutive month, with sales up by 12.9% – its quickest rate of growth since May 2021. This put it ahead of the total online market, which expanded by 4.4%.

Meanwhile, Asda was again the worst-performing retailer, with sales sliding 5.6%, resulting in its market share falling from 13.8% to 12.6% over the last year.

Lidl’s sales were 9.1% higher than a year ago, with footfall in August boosted through digital vouchers for bakery items. It now accounts for 8.0% of the grocery market, having won share every month since April 2021.

After figures posted yesterday confirmed it saw strong growth last year, Aldi continued its poor run in 2024, with sales up only 1.3%.

Meanwhile, Tesco strengthened its lead position after seeing sales rise 5.3%. It now controls 27.8% of the market (the highest figure since January 2022) after increasing its share by 0.6 percentage points since last year. Sainsbury’s market share nudged up to 15.2% after sales increased by 5.7%. Morrisons continued its steady improvement, with sales growing 2.7%.

Sales at Waitrose increased by 4.0%, ahead of the wider market, while its share of spending was maintained at 4.6%.

Looking further ahead, Kantar noted that retailers and brands will be waiting to see how the Chancellor’s Autumn Budget could impact household incomings and outgoings. Despite grocery price inflation easing back, shoppers’ financial confidence hasn’t improved.

Kantar’s latest PanelVoice Pressure Groups Survey found that nearly 60% of shoppers are still very or extremely concerned about rising grocery prices. This is their second biggest financial worry, only behind home energy bills.

Fraser McKevitt, head of retail and consumer insight at the research group, said: “Retailers have been doing their bit to help shoppers keep the cost of the weekly shop down, and the proportion of sales on promotion increased year-on-year for the sixteenth month in a row in August. More than half of all grocery trips include some kind of deal, and this proportion rises as the trolley gets bigger.”

NAM Implications:

- We are patently still in uncertain territory re the real impact of inflation on consumer willingness to spend.

- And Tesco and Sainsbury’s growing share at the expense of Asda and Morrisons.

- Whilst Asda are all activity, much ground needs making up in terms of actual sales improvement.

- And difficult to see how they can cut their way out of trouble.

- Meanwhile, Aldi has to find a way forward but still have an offering that suits the market.

- Roll on Retail Media…