Two-thirds of consumers are concerned about climate change, but only 15% are prepared to pay extra for environmentally friendly food and drink, according to a survey carried out by Euromonitor International.

Eco Logical is one of Euromonitor’s five Global Consumer Trends for 2025 and comes as the debate on climate change hots up after recent major weather events around the world. The research highlights that consumers continue to make choices that positively impact the environment but are adopting an affordability mindset.

“Spending on sustainable products remains a conscious decision based on personal values, but consumers also pay close attention to the key benefits these products deliver. Sustainability claims require tangible evidence,” said Inga Klebanskaja, senior research consultant at Euromonitor International.

“The Eco Logical trend challenges businesses to create the right claims on the right products for the right audience. Sustainability is no longer brand-enhancing but a prerequisite for innovation that drives growth.”

The survey found that more than 63% of consumers have tried to adopt habits that are positive for the environment in 2024 due to worries about climate change.

Klebanskaja added: “Trust in green labels hasn’t wavered over the years, but affordability continues to be the top barrier. Some 40% of consumers said high price prevented them from making sustainable purchases.

“In 2024, 52% of consumers considered eco-friendly labels trustworthy. Only 15% would pay more for these food and drink products.”

Euromonitor found that the number of online Stock Keeping Units (SKUs) with sustainability claims increased from 4 million in 2022 to 5 million in 2024 across 11 FMCG industries and 25 countries.

Klebanskaja concluded: “Brands with a tangible sustainable proposition saw a 1.5% higher growth rate over the same period compared to non-sustainable equivalents.

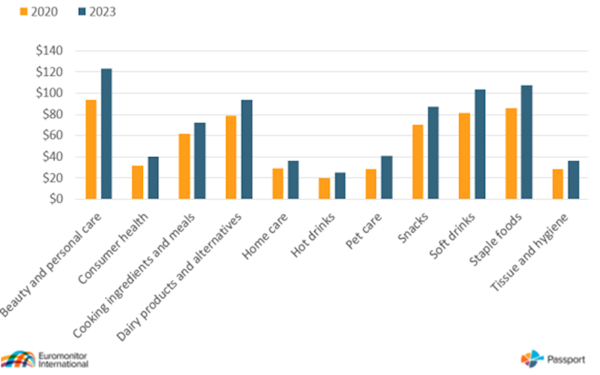

“Beauty and personal care brands’ enhanced offers in this space have generated more than US$120bn in 2023, the highest industry by sales. Pet care products with sustainability claims recorded the strongest compound annual growth rate (CAGR) from 2020 to 2023.”

Global retail sales of sustainable products by industry

Source: Euromonitor International, Passport Sustainability

Klebanskaja concluded: “Businesses need to use sustainability claims to show the value of their product and connect those features to qualities that drive consumers’ buying decisions – efficacy, quality or safety. They should build sustainability into products or services that are familiar to their target audience for easier adoption.”

NAM Implications:

- The problem for those driving ‘Green’ and associated issues…

- …is that, as one goes further down the income table…

- …consumers are increasingly distracted by the real cost of living.

- This means that the more additional cost pressures the government imposes on this group of consumers….

- …the larger this group of consumer-voters will grow as a proportion of the population.

- Who knows what effect that will have on ‘Green’ and associated issues?