A new study by Circana confirms that supermarket private label lines are driving a significant transformation in the FMCG sector across Europe.

The report – Private Labels: Transformation for Growth – highlights how retailers have capitalised on shifting consumer behaviours, offering affordable, high-quality products that meet evolving demands for health, sustainability, and value.

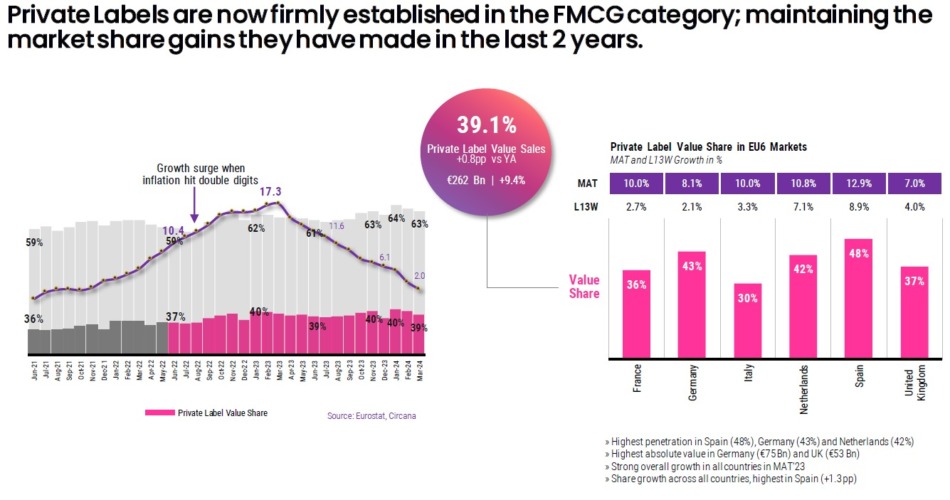

Despite intense inflationary pressures across the FMCG landscape, the private label market achieved 9.4% growth in value sales and a 2.2% increase in volume sales across the largest six European markets (France, Germany, Italy, Netherlands, Spain, and the UK) as of March 2024. With a 39% market share in value sales and a 46% share in unit sales, private labels have firmly established themselves as key players in the sector.

“Private labels have redefined the competitive landscape, not just by offering lower prices but by consistently delivering quality, innovation, and sustainability,” said Ananda Roy, Senior Vice President of Thought Leadership at Circana.

“Their success underscores a broader consumer shift towards brands that align with their values, particularly in health-conscious and eco-friendly categories.”

The report reveals that categories such as Chilled & Fresh Foods, Household Care, and Personal Care have seen the highest private label penetration, with notable gains in Baby Food (+2.3pp) and Pet Non-Food (+2.2pp). Spain, Germany, and the Netherlands lead in private label market penetration, with Spain achieving a 48% market share.

While private labels surged, national brands showed modest recovery through aggressive promotional strategies. However, even with 43% of national brand units sold on promotion in the UK, they continue to lag private labels in overall growth.

Circana’s report outlines four strategic options for brands looking to compete effectively: diversify into adjacent categories, grow the category through innovation, preimmunise distinctively, and collaborate strategically. Brands that focus solely on promotions without investing in innovation risk falling behind in an increasingly dynamic market.

Circana also warns of a slowdown in category innovation, with 17% fewer new product launches observed due to supply chain disruptions and a focus on core product ranges. This presents a risk of the FMCG sector becoming an ‘innovation desert,’ with the consumer insight firm emphasising the need for both private labels and national brands to prioritise innovation to drive organic growth.

Continued growth momentum is forecasted for private labels, driven by investments in range expansion, premiumisation, and sustainability initiatives. Consumer preferences for health, wellness, and ethical consumption is expected to continue to influence purchasing decisions, reinforcing the importance of aligning product offerings with these values.

Meanwhile, with a positive GDP growth forecast for the Euro area in 2025 (+0.4pp YoY), Circana predicts a cautiously optimistic outlook for FMCG growth. Private labels are expected to continue their strong momentum, driven by investments in range expansion, pricing strategies, and product innovation. However, the firm suggests that national brands have the potential to narrow the gap if they pivot towards innovation and diversify their portfolios. As both sectors adapt to evolving consumer demands, the FMCG landscape is set to remain dynamic and highly competitive in the year ahead.

Roy concluded: “2024 marked a pivotal year for the FMCG industry, with private labels setting a new standard for growth and innovation. Looking ahead, 2025 will be a defining year for both private labels and national Brands, as long-term success will hinge on their ability to innovate and connect with evolving consumer needs. The opportunity is open for all brands to differentiate themselves and deliver products that resonate with today’s value-driven consumers.”

NAM Implications:

- Private labels are succeeding (and becoming ‘sticky’)…

- …by retailers consistently delivering quality, innovation, and sustainability to the extent that consumers are sufficiently satisfied with the brand substitute as not to revert back to the brand alternative…

- …at a ‘price’ to brand owners in terms of additional brand spend or a price reduction.

- To bridge the gap, this article could help…