A new supermarket ranking report by YouGov reveals that when people in the UK are asked: “When you are in the market next to purchase groceries, from which of the following would you consider purchasing?”, Tesco tops the chart.

While the UK’s largest grocer comes out on top for all genders, women are more likely to favour Marks & Spencer and Waitrose than men, and men are more likely to favour Tesco Express and Morrisons.

In addition to overall consideration scores, the YouGov study digs into how particular supermarket brands are perceived. Aldi and Lidl are the two brands customers feel offer the best value for money. M&S holds a commanding lead in terms of being perceived to offer high quality, with Waitrose in second place:

In addition to overall consideration scores, the YouGov study digs into how particular supermarket brands are perceived. Aldi and Lidl are the two brands customers feel offer the best value for money. M&S holds a commanding lead in terms of being perceived to offer high quality, with Waitrose in second place:

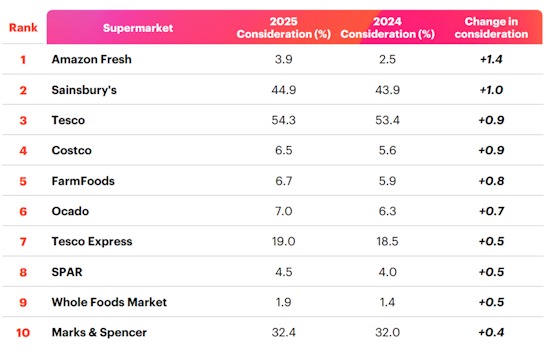

The retailer which has seen the largest improvement to its consideration score is Amazon Fresh, indicating that recent initiatives to broaden its appeal are having an effect.

The retailer which has seen the largest improvement to its consideration score is Amazon Fresh, indicating that recent initiatives to broaden its appeal are having an effect.

Sarika Rana, Head of Consumer Insights, YouGov UK, commented: “The reality of the UK grocery sector is that every single customer must be fought for, so Tesco topping our table as the most considered supermarket is a notable achievement. The strong performances of other major brands on our list highlight both the competitiveness and diversity of the industry.

“If we drill down into the different metrics, Tesco’s strong performance no doubt comes, in part, from its high rankings in both quality and value 0 a noteworthy achievement in a landscape where consumer perceptions of other brands tend to lean more toward one or the other. M&S holds a commanding lead on quality, with Waitrose in second place, while expectedly, discounters like Aldi and Lidl top the charts on value perception

“As a relatively new entrant to the market, Amazon Fresh’s position as the most improved brand highlights its growing presence. By introducing unique technological innovations to the UK, the brand is gaining traction, and we will monitor through our data to see if it continues on this trajectory.”

NAM Implications:

- Always helps to be top of mind…

- But the discounter scores must be of concern in the continuing consumer uncertainty…

- …not only to the mults…

- …but also to non-stockist suppliers.

- BTW, worth considering whether Aldi and Lidl represent more of a threat

- To the size of brand premia?

- Or to the market shares of the mults?

- Meanwhile, unprecedented change continues…