Latest NielsenIQ (NIQ) figures reveal that Total Till sales growth in UK supermarkets slowed to 2.7% in the four weeks to 23rd March, down from 4% the previous month, impacted by the later timing of Easter and Mother’s Day as well as consumers tightening their belts ahead of the raft household bill rises in April. The data also shows that food inflation rose last month to 2.4%, up from 2.1% in February.

NIQ highlighted the results of a recent survey confirming that grocery consumers are looking for value for money to counter the pressure on their budgets. 47% of consumers said they were purchasing more supermarket own-label items than they ever have before, with 75% saying they were a good alternative to brands.

As shoppers search for the best prices, the data shows that in-store visits rose (+6.8%) last month while sales growth in the online grocery channel slowed (+0.7%), continuing the downward trend seen since the start of 2025 and bringing its market share down to 12.9% compared to 13.2% this time last year. Spend per visit across all channels also fell 3.4% to £19.10.

In terms of category, over the last 4 weeks, sales of dairy products rose (+7.2%), alongside meat, fish and poultry (+5.9%). Warmer weather in March also saw sales of soft drinks grow (+6.8%). However, the late Easter and Mother’s Day led to confectionery sales falling (-16.7%) compared to the same time last year. Sales of beer, wine and spirits also fell (-4.3%).

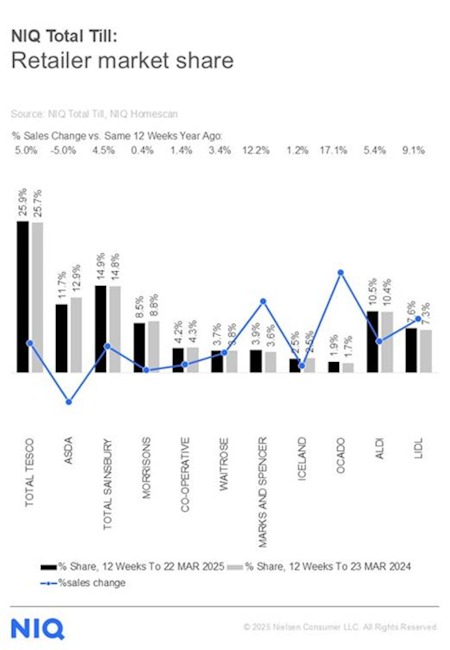

Looking at the performance of individual retailers, almost a quarter (24%) of all households shopped at M&S over the four weeks, with the retailer maintaining its strong sales growth (+12.2%) and seeing its market share increase to 3.9% from 3.6% a year ago.

Tesco, Sainsbury’s, and the discounters continued to perform well. However, Asda suffered another hefty decline (-6.0%) in sales, which NIQ suggested could be due to recent price cuts as the struggling chain adopts a new pricing strategy.

“Shopping behaviour continues to evolve, with consumers increasingly shopping around for the best prices and offers whilst looking to stretch budgets ahead of planned rises to essential bills at the start of April,” said Mike Watkins, Head of Retailer and Business Insight at NIQ.

“This could be helping discounters capture a greater share of the regular weekly shop. The channel now holds an 18.1% share of all FMCG sales in Q1 – the highest in over two years – with an average spend per visit of £24.09.”

He added: “Looking ahead, retailers have reasons to be optimistic this dip in sales won’t last. Sunnier weather at the start of April and the lead up to Easter will encourage extra spend, which will then improve topline sales. We expect all retailers to keep an eye on the favourable start of spring.”

NAM Implications:

- Changes in consumer shopping behaviour becoming embedded…

- Search for value

- Brand to own label switch, with 75% saying they were a good alternative to brands.

- Switching from mults to discounters

- The more satisfied these consumers become with the ‘compromise’…

- …the more expensive it becomes to win them back to brands.

- Watch this space…