Latest data from NielsenIQ shows that Total Till sales at supermarkets in the UK grew 4.1% during the four weeks to 6th September, an improvement on the 3.7% uplift recorded the previous month. The figure was boosted by shoppers shifting their focus to back-to-school items and early preparations for Christmas, while rising inflation (+4.1%) also increased overall basket value. However, across the grocery multiples, unit sales fell 0.2%.

With household budgets squeezed, NielsenIQ noted that retailers were reluctant to pass on the full cost of business and supply chain pressures. As a result, sales of items purchased under promotions increased slightly to 23.5% of sales, with shoppers leaning on loyalty card discounts to secure the best deals. Visits to stores continued to rise (+4.8%) as people sought out the best deal, while online shopping occasions grew (+1.9%). This also reflected the ongoing ‘little and more often’ shopping behaviour across both grocery channels.

Looking at category trends, meat, fish, and poultry saw a strong increase, with total sales up 9.2% and units rising 1.6%. Soft drinks also performed well, with sales up 10.6% and units purchased rising 4.4%, supported by the sunny weather at the end of August. In addition, health, beauty and toiletries saw sales rise 6.2% with the number of items up 1.5%.

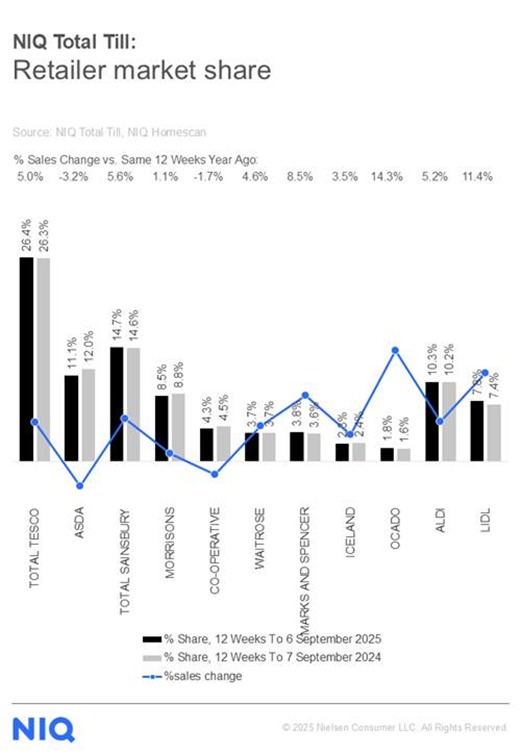

In terms of retailer performance, Lidl (+11.4%) and Ocado (+14.3%) continued to lead growth, with Marks & Spencer also growing strongly (+8.5%) as it recovers from the recent cyber attack. In the last 4 weeks, one in four shoppers visited Marks & Spencer, a 11.9% increase on last year, enticed by the new seasonal food ranges, new store openings and social media engagement. Sainsbury’s (+5.6%) and Tesco (+5.0%) also gained market share, with Waitrose (+4.6%) maintaining momentum throughout the summer.

“Following the hottest summer on record, which encouraged spending and sustained food and drink sales, the industry now faces the challenge of navigating higher inflation,” said Mike Watkins, Head of Retailer and Business Insight at NielsenIQ.

“One in three households currently identify the cost of living as their top concern, up from 22% in March, while nearly two-thirds of shoppers report being moderately or severely affected by rising costs, compared with 56% a few months ago. As households switch their heating back on and prepare for additional spending ahead of Christmas, most consumers anticipate that financial pressures are set to increase further.”

NielsenIQ pointed to research showing that 75% of households now believe it’s important or very important to actively save money on their grocery bills. This suggests that the build up towards Christmas could be slower than in previous years.

Watkins added: “Looking ahead, with many shoppers unable, unwilling, or reluctant to spend freely, if food inflation reaches 5% or more by the end of the year, this could limit some of the volume increases typically seen during the Golden Quarter. So for retailers, three key challenges lie ahead: securing sales growth in the face of rising inflation to drive volume, encouraging ‘trading up’ across different shopping missions, and ensuring that media messages and forthcoming advertising campaigns resonate with increasingly price-sensitive consumers.”

NAM Implications:

- Shoppers continue to shop around for value…

- …with the added benefits of increasing their ability to compare rival retailers offerings, close up.

- (and vote with their feet, where necessary…)

- Patently own label benefits.

- And these new shopping habits will prove difficult and expensive to reverse..

- Meanwhile, Asda and Morrisons continue to fight against the clock.

- While Golden Quarter promise is losing some of its sparkle?