Official figures from the Office for National Statistics (ONS) suggest that back-to-school shopping and warm weather boosted retail sales last month, although the sector looks set for a tough few months due to high inflation and economic uncertainty.

Total retail sales volumes rose 0.5% in August, slightly better than the 0.4% increase that some analysts had forecast.

Non-food stores (department, clothing, household, and other) rose by 1.1%, while food stores experienced a 0.5% rise as specialists, such as butchers and bakers, recovered from poor sales in July.

However, the ONS noted that across the three months to the end of August, retail sales fell by 0.1% compared with the previous quarter. It said falls in automotive fuel and computer and telecoms equipment stores were partly offset by increases in non-store (online) retailing and clothing stores.

“Modest headline sales growth [in August] compared to last year is encouraging, but much of the uplift was driven by inflation, seasonal events and promotions, rather than a meaningful rebound in consumer confidence,” said Nicholas Found, Head of Commercial Content at Retail Economics.

“Discretionary categories such as clothing, beauty and tech saw selective gains, driven in part by affordable luxuries tied to innovation. But this masks a widening gap in behaviour, with lower-income households still adjusting to higher living costs, as above-target inflation squeezes budgets.

“In this environment, it’s a battle for market share. Retailers are competing for a slice of constrained spending, where gains often come at a competitor’s expense. Retail giant Next’s latest trading update pointed to a sales boost following disruption at Marks & Spencer, highlighting just how finely balanced performance is in a market shaped by selective demand and operational advantage.

“Confidence remains fragile, and with the Autumn Budget landing unusually late in the golden quarter, uncertainty around tax, borrowing costs, and real incomes could drag on demand just as retailers enter their most important trading period.”

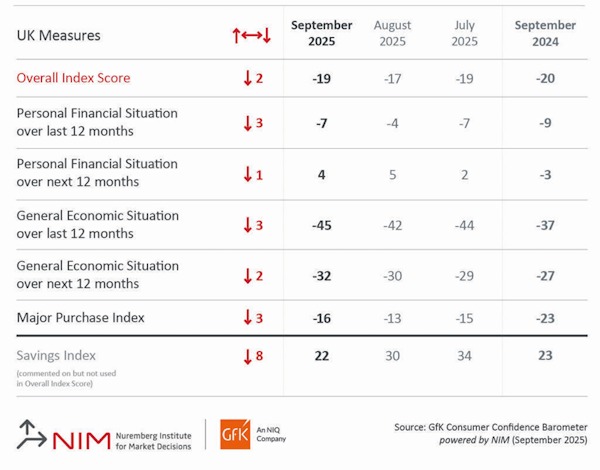

GfK’s consumer confidence index decreased by two points to -19 this month. All figures used to compile the measure were down in comparison to last month’s announcement:

Neil Bellamy, Consumer Insights Director at GfK, noted that the August cut in interest rates had not provided any obvious boost to the financial mood of consumers or drawn attention away from day-to-day cost issues. “With tax rises expected in the November budget, the risk is that confidence inevitably falls, just like the autumn leaves,” he added.