Having survived three years of total change, change radical and unprecedented, it would be unwise to continue to apply the same pre-Lockdown strategies and expect them to work as well as before…

Focusing on fire-fighting and survival, and responding by instinct may yield short-term gains, but business success in the New Norm requires a fundamental rethink of all that has gone before, a reassessment of our consumers, customers, and competitors. This is necessary in order to have a reliable basis for re-tailormaking an offering that can meet consumer needs better than available competition…

Whilst pre-Lockdown structural changes such as the emergence of the ‘squeezed middle’, bricks & mortar retailers coping with longtail-redundancy in terms of 80% of sales coming from 20% of the assortment, 20% aisle-redundancy arising from culling of SKU duplication overlap and online, long-term property lock-in preventing major retailers from optimising consumers’ convenience needs to shop smaller, closer and more often, all causing significant changes in consumers’ shopping behaviour, these changes were more or less manageable in that they all came single file with some overlap, and affected different retail channels to differing degrees, in different geographies…

The above structural changes meant that within a few years, we could have expected the Mults to move from a 64.5% share of the grocery market (Kantar) to something closer to 50%, as pure-play online, the discounters, and local convenience grow around them. If in doubt, why do you think their share prices are still being hammered?

The big difference with Lockdown was the fact that it occurred simultaneously (March 2020) in every country, a uniform formula was applied in almost the same way everywhere, and delivered a catastrophic shock to all consumers, retailers and suppliers, everywhere…

Change of this degree demands that we revisit all of our business assumptions in order to make it possible for survivors to move forward in the New Norm. Unless we take this fundamental step now, we are simply going to delay an inevitable loss of share as we slide first slowly and then quickly towards oblivion. There can be no half-measures or half-waypoints…

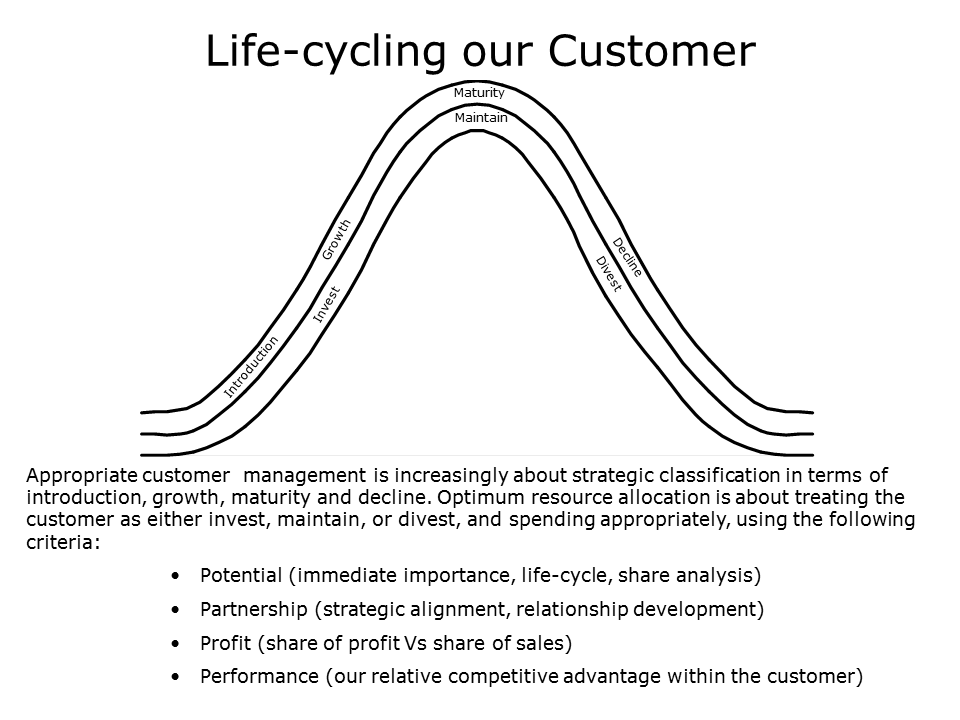

Given the fact that in most cases, a NAM, being closer to the ground, is in an expert position in terms of helping their companies to re-visit the customer portfolio, and classifying each player as invest, maintain and divest partners in this fundamentally changing trading environment.

Risk-Profile Compatibility:

Those companies that have survived Lockdown-fallout thus far have done so in part because of the consistency of their risk profile. Given three possibilities, Risk Seeking (willingness to take calculated risk), Risk Neutral (a midway point between Risk Seeking and Risk Averse), and Risk Averse (risk avoidance), it has to be said there is no place for risk-averse companies in the New Norm.

It is therefore imperative that a company, in the current Lockdown-fallout conditions, has a clear and accepted internal vision of itself as Risk Seeking or Risk Neutral.

Having clarified this position, then choosing trade partners of appropriate risk profile is key… In doing so, it is important to partner with complementary customers i.e. a risk-seeking supplier providing the drive for a risk-neutral customer, or vice versa. Incidentally, those risk-seeking suppliers with a taste for extra excitement might choose to partner heavily with risk-seeking customers…

Before leaving Risk, a brief reassessment of your perception of surviving Competitors’ Risk profiles might help in anticipating their probable responses to your initiatives in the category.

Customer Lifecycle:

Keeping in mind that your customer portfolio is (or should be) changing radically to reflect New Norm pressures of online, discounter encroachment, it follows that surviving retailers will have changed position on their lifecycle for your business…

In other words, circumstances will have caused them to shift in terms of being at Introduction, Growth, Maturity or Decline, and it is vital that any perceived change be factored into your trade strategies, keeping in mind that you need a balanced mix across the portfolio i.e. new customers being fed in to replace those in decline.

Customer Partnership Status:

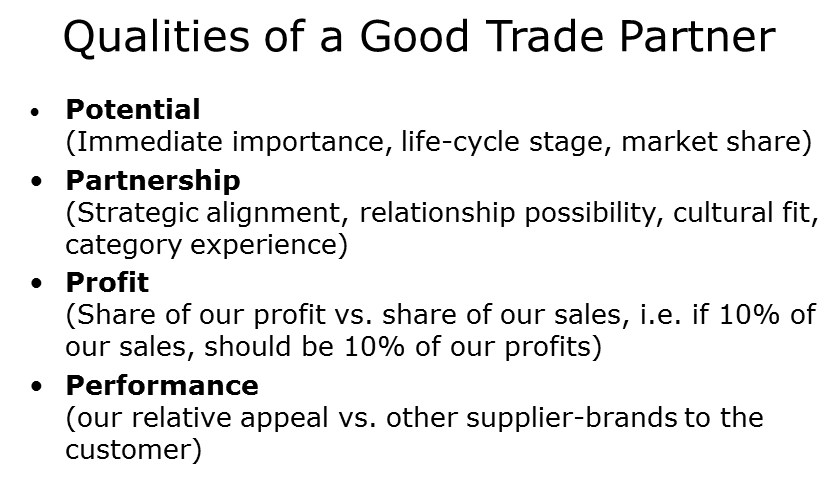

Classify each customer – and potential customer – in terms of ideal fit with your type of supplier.

Here you will pull together your updated Risk Profiles and Customer Lifecycle assessment in terms of appropriate fit with your strategies to determine how closely you want to align with each customer.

Customer Investment:

Given the importance of optimising your relationship with your surviving customers, and taking into account the radical changes being driven by the development of Retail Media, it is important to determine the degree to which your company is prepared to invest in each.

The above analyses will help, but it is key to factor in the fact that individual customers will have differing levels of appetite and justification for shares of the traditional media budgets that will inevitably transfer to retailers that can provide robust first-party data as the mine and repackage their shopping insights, at the expense of traditional TV and press. This means labelling your customers as Invest, Maintain or Divest and allocating funds accordingly.

Sources of growth:

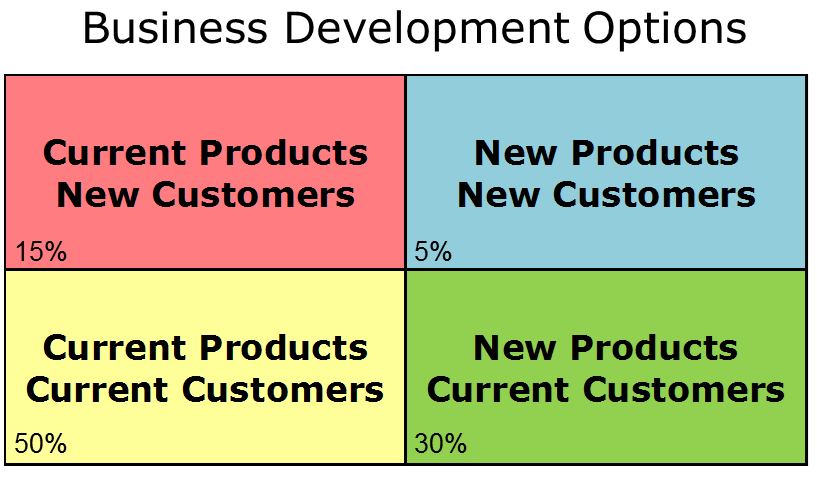

For each customer, use the Ansoff Matrix to identify the four ways of growing your business.

In other words, you now have a clear idea of the relative health and suitability of each customer. It is now time to take a deeper dive within a realistic context of Lockdown fallout to determine potential sources of the business growth required by your company.

Conducting the above analyses, and ensuring your company aligns accordingly, will help in optimising the potential of surviving consumers that are emerging supper-savvy, unwilling to accept anything less than demonstrable value for money, every time…

Unless you prefer to try the old way, one more time?