New research suggests that fewer consumers are considering purchasing products from the Heinz Beanz range as price rises and the cost of living crisis impacts consumer choices.

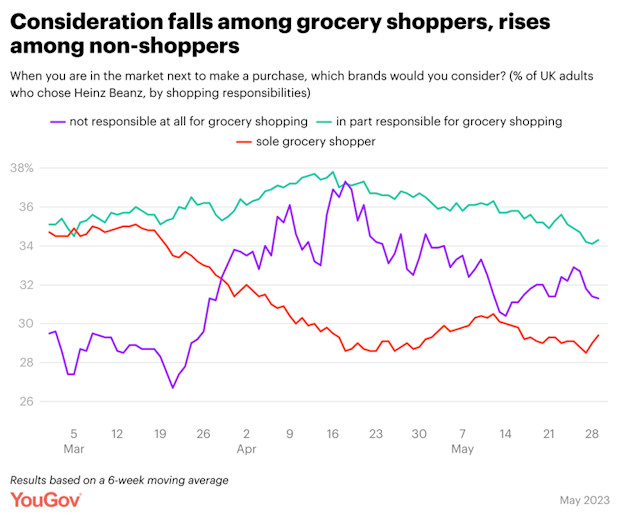

According to the YouGov BrandIndex, Heinz Beanz has seen its purchase Consideration score fall from 35% to 29% over recent months amongst those who are the sole shoppers in their household.

Among those who are partly responsible for the shopping, Heinz Beanz’s Consideration score has fallen from 36% to 34%. Among the general population, Consideration slid from 35% to 32%.

The data tracks the brand’s Consideration score – measuring the likelihood of considering a brand’s products when next purchasing – between 1 March and 29 May – and finds that over this period the number of consumers in Britain who consider purchasing Heinz Beanz has dipped.

YouGov noted that price increases are likely to have contributed to the decline in purchase consideration, as over the past year the prices of Heinz products have risen faster than many of its competitors, with the result that a can of Heinz Beanz can cost considerably more than own-label equivalents.

Consumers’ discontent with rising prices is reflected in Heinz Beanz’ Value score, which measures perceptions of the brand’s value for money. From the beginning of March to the end of May, Heinz Beanz’s value score amongst primary shoppers fell from 12 to 4.

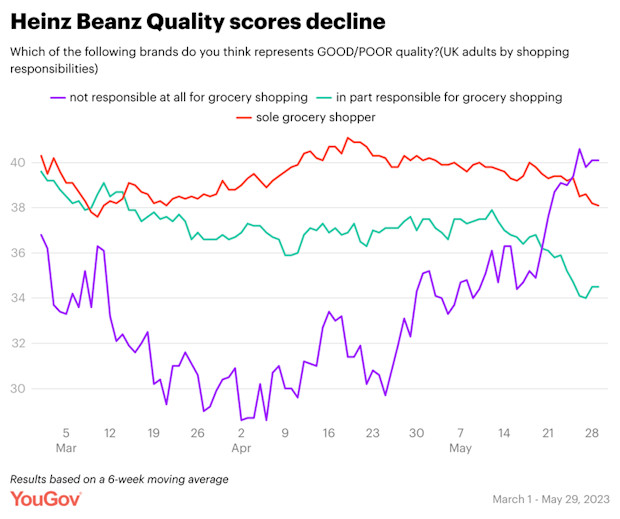

Heinz Beanz’s Quality score also declined from 40% to 35% over the same time period amongst those who are the sole shoppers in their household. Among those who are partly responsible for the shopping, the Quality score dipped from 40% to 38%. This coincides with a widely-publicised taste test in early March which saw Heinz Beanz place behind store brands such as Asda, Aldi and Lidl.

Last month, Kraft Heinz admitted it was seeing continued competition from own-label alternatives, with it deploying promotional activity in response to the threat.

And last week, the company unveiled a new global campaign under the slogan ‘It has to be Heinz’, which marked the first time in its 150-year history where the brand is unified under one creative strategy.

NAM Implications:

- Patently any Retail Media Network that can supply First Party Data on sole shoppers in their household….

- …has to have a big potential RM opportunity with Heinz.

- Meanwhile, Heinz are facing a double-whammy threat:

- Heinz prices have risen faster than many of its competitors…

- …resulting in the brand premium vs own-label equivalent being ‘considerably more…’

- Heinz are in need of a price reduction…

- …or more effective advertising.

- Watch this space…