Analysts at insights firm Edge by Ascential have updated their pre-existing forecasts to account for the significant long-term impact of the coronavirus pandemic on consumer shopping behaviours and preferences.

The recent surge in online shopping caused by the crisis is expected to add an extra £5.3bn to UK e-commerce sales this year. Prior to the pandemic, analysts had expected the e-commerce market to grow 11% to £73.6bn during 2020. However, online sales are now on track to grow 19% to £78.9bn.

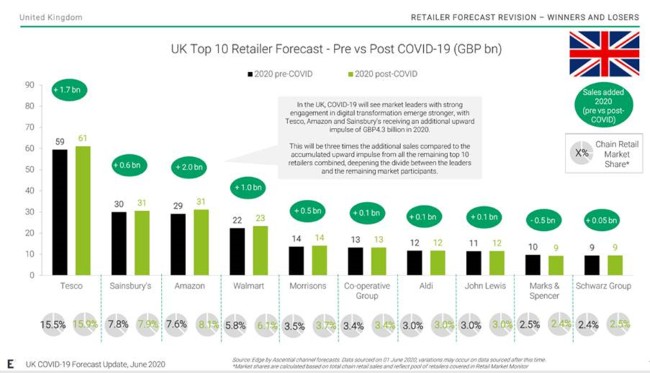

Amazon looks set to benefit the most from this increase in demand with it likely to add an extra £2bn in UK sales, totalling £31.1bn by the end of 2020. This is up from analysts’ previous forecast of £29.1bn.

However, Tesco will still generate the most revenue in the retail sector in 2020, with gross sales forecast to rise by an extra £1.7bn to reach a total of £61.1bn, up from previous predictions of £59.4bn. This is followed by Sainsbury’s, which is on track to add an extra £0.6bn in sales to reach £31bn (from £30bn) by the end of the year.

Analysts at Edge Retail Insight, the trend forecasting arm of Edge by Ascential, have also upgraded the UK outlook for other retail channels:

- Grocery hypermarket stores: A revised growth of 3.3%, up from -0.8%, as a result of increased home cooking, following the cautious reopening of eateries and restaurants. This will now account for £82.7bn in sales.

- Pharmacies and health retailers: Health stores will see a significant boost, up from initial predictions of -4.6% to a growth of 4.0% in 2020. This will account for £13.8bn in sales, as conscious consumers continue to look after their health post-pandemic.

- Discounters (9.2% up from 8.7%) and neighbourhood stores and supermarkets (3.0% up from -0.4%) will experience modest growth at £28.9bn and £21.1bn respectively. Cash & carry operators (up 8.0% from 7.6%) will see a small increase.

However, predictions for other retail channels have been revised down by the analysts because of disruption caused by the coronavirus outbreak:

- Department stores: Following months of store closures, growth will further decline from initial predictions of -1.1% to -17.8%, to an estimated £12.9bn in 2020, as shoppers are expected to continue to shop online despite stores reopening.

- Convenience stores: Growth is revised down to 5.2% from 6.2% prior to COVID-19 but is still expected to reach a modest £28.4bn in 2020, from £28.7bn in 2019.

- Beauty specialists (down to 1.4% from 3.6%) will experience a significant decline in sales post-COVID-19, as beauty businesses remain some of the last retailers to reopen

Xian Wang, Senior Director of Product and Content at Edge by Ascential, said: “The COVID-19 pandemic has almost certainly had a lasting impact on the retail sector, reshaping consumer shopping habits, and the priorities for retailers and brands. Most prominently, we’re seeing a significant shift to online, as consumers have become reliant on this, following the swathe of store closures globally. This will no doubt lead strong e-commerce players, such as Amazon, to benefit from this greatly.”

Wang added: “We are one of the first retail insights firms to review and update all of our forecasts for 2020, which are crucial in helping businesses recalibrate in the post-COVID-19 retail landscape. Our new features and revised research reports and insights will be essential in helping to guide businesses carefully as they seek to revise route-to-market execution strategies in this new environment.”