Amazon is on track to overtake Tesco as the UK’s largest retailer within the next four years, with its gross merchandise value (GMV) sales expected to reach £77.1bn by 2025, according to a new report forecasting the future performance of key retailers.

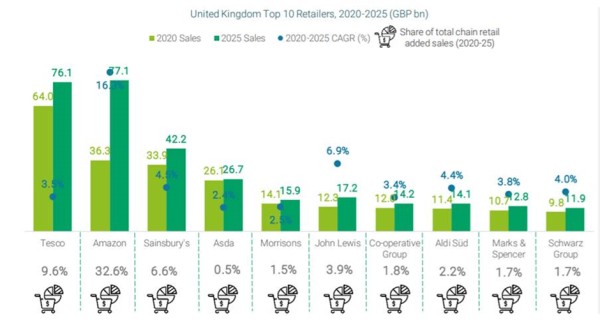

The study by Edge by Ascential’s research arm, Edge Retail Insight, shows Amazon’s total sales (incl. marketplace) in the UK were £36.3bn in 2020, compared to Tesco’s £64bn. By 2025, Edge predicts that Tesco’s total sales will rise to £76.1bn, representing CAGR growth of 3.5%, but just behind the US online giant.

Amazon is expected to account for a third of all UK chain retail sales added between 2020 and 2025, with compound annual sales growth (CAGR) of 16.3% for the five-year period. The e-commerce giant is also forecast to account for 15% of UK chain retail sales in 2025, up from 9.1% in 2020.

In the edible grocery category, Amazon is still a relatively small player in the UK, despite growth of 17.6% in 2020 at the height of the pandemic when health concerns saw more people buying essentials online. However, by 2025, Edge by Ascential expects Amazon UK to become the 15th biggest seller of edible grocery products, up from 19th currently, surpassing Shell, McColls, BP and Wilko.

Meanwhile, the UK Retail Landscape And Go-To-Market Planning report says that Sainsbury’s will hold on to its position as the UK’s third-largest retailer, with CAGR sales growing by 4.5% to reach £42.2bn by 2025. CAGR sales at Asda are expected to grow by 2.4% to £26.7bn by 2025 to come in at fourth place by 2025.

The report analyses the performance of chain retailers and channels performance in the UK as of March and explores market characteristics to determine where suppliers should focus their investment.

The data from Edge suggests that a third (33.4%) of all UK chain retail sales will occur online by 2025, up from 26% in 2020, outperforming all physical channels by a stretch. E-commerce sales are forecast to grow from £105.2bn in 2020 to £176.2bn by 2025.

The only other channel to grow market share over the next few years is expected to be the discounters, which will account for 8.2% of UK chain retail share by 2020, up from 7.9%. All other channels, including supermarkets, will lose market share by 2025. Foodservice is expected to remain static.

Edge analysts also highlight the rapid growth of e-commerce in UK grocery retail, with online penetration rising from 8.2% to 10.9% by 2025. Leading retailers are adapting to the shift in consumer spending patterns at pace, innovating in last-mile delivery with delivery intermediary partnerships and investing in automation in warehouses.

Deren Baker, CEO at Edge by Ascential, commented: “The UK is one of the largest retail markets in Europe, and a key market for many brands around the world. Our data shows that e-commerce is expected to grow in the UK over the next few years, and this will be driven by digital marketplace giants like Amazon, and omnichannel marketplace giants like Tesco.

“Over the past year, Amazon has grown its online retail footprint in the UK and expanded into the high street, with the launch of three Amazon Fresh shops in London and a high-tech hair salon, where it can trial technology and product innovation and increase brand presence in the fast-growing beauty sector.”

Commenting on the rise of online grocery, Robert Gregory, Advisory Research Director at Edge by Ascential, said: “The past year has seen online grocery accelerate in the UK, a market which already had one of the world’s highest penetration rates for online grocery. While Amazon has seen sales grow strongly, so have the larger grocers, with the likes of Tesco, Sainsbury’s and Asda all being able to expand capacity for their online services. Tesco recently revealed a 77% increase in online sales during its 2020-21 full year results after doubling its online capacity to 1.5 million slots a week.

“Growth will also be driven by leading players looking to improve delivery speed, including partnerships with last-mile delivery specialists such as Deliveroo and Uber Eats.”

Baker added: “Physical stores will remain an important channel but consumer packaged goods (CPG) brands must prioritise their online strategies to capture growth opportunities, particularly in mature digital markets, like the UK.

“That means understanding how to convert shoppers online through digital touchpoints, such as marketplaces like Amazon, where many now begin their purchase journeys. The next five years will be defined by the ability of CPG firms to leverage the might and skill of marketplaces to acquire customers. This is next-generation retail – Retail 5.0 – marketplaces mastering personalisation at scale. CPG brands must focus investment on winning market share through the online platforms most relevant to them.”