After May’s freefall, online retail sales growth fell only 2.3% year-on-year in June 2022, according to the latest IMRG Capgemini Online Retail Index.

Whilst this is the smallest decline to date in 2022, it is being compared against a result of -8.6% in June 2021, which points to a slightly less positive picture.

Equally, though the month-on-month growth increased by 1.5% against May, suggesting a slight levelling of sales, typical growth for this time of year is around 2–5% – putting this result at the low end of ‘normal’.

Elsewhere, after rising rapidly since January, the Average Basket Value (ABV) seems to have stabilised for the first time this year – dropping from last month’s peak of £150 back to £145. This is still high historically, suggesting that consumers continue to prioritise quality over quantity with their purchases.

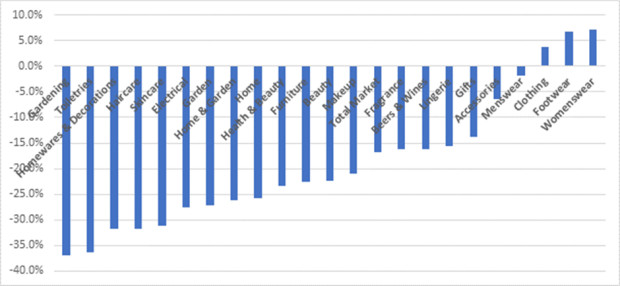

At a category level, the trends seen throughout first half continue to dominate, with all categories reporting negative growth aside from clothing. Looking at the graph below, it shows the extent to which category growth has been negative in 2022. The total market is down 16.7% in the first half, with categories such as gardening and homeware plummeting over 30%. Meanwhile, clothing continues to recover from the pandemic at +4% YTD and +11.3% YoY, perhaps buoyed by the uptick in in-person events and summer travel.

Andy Mulcahy, Strategy and Insight Director at IMRG, commented: “It speaks volumes that a decline of 2.3% feels quite good in the context of 2022. The cost-of-living crisis is having a profound impact on customer behaviour in ways that set it apart from the pandemic. For example, while the pandemic drove massive growth online, it didn’t change things like average spend or conversion. If we compare a lockdown period (Q4 2020) with a non-lockdown period (Q4 2021), the differences in some metrics are negligible – the percentage of visitors who view a product page on retail sites fell -3.5%, while the percentage that add something to their basket and proceed to the checkout fell -4.5%. Comparing Q1 2021 with Q1 2022, as the cost-of-living increases started to bite, those falls are 12% and 22.7% respectively. In some respects, incredibly, it is having a bigger impact.”

Jeremy Wilson, Director of Commerce, Customer Transformation & frog Tech at Capgemini, added “Though the headline numbers indicate some continued impact of Covid-19 – as the categories that did well during that time fall back and those that didn’t pick up – a deeper dive into the wider trends does show that the cost-of-living crisis is having a very different effect on consumer behaviours.

“Boiled back, the pandemic mainly drove a channel switch – changing where budget was spent, but not necessarily how much and how often. The conversion drops and basket value increases we’re seeing now appear to show that the cost-of-living crisis is having a far greater impact on consumers’ spending caution and prioritisation of goods. It will be interesting to track these numbers over the coming months, particularly as energy costs soar ever higher.”

NAM Implications:

- This is about Lockdown causing a channel switch.

- Key is to compare your business, category by category.

- Then anticipate an inflationary cost-of-living impact…

- …that has hardly begun, in statistical terms.

- i.e. a lot more to come.