By Martin Heubel, Amazon Strategy Consultant at Consulterce

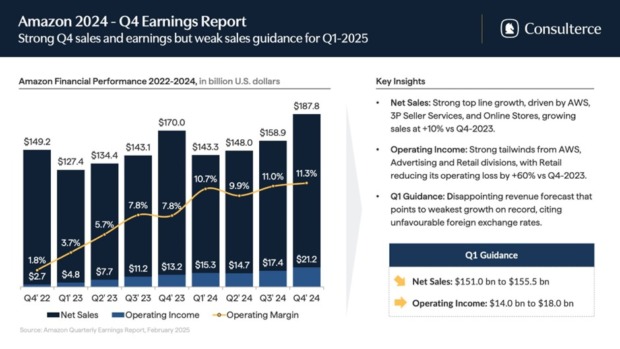

Amazon’s Q4 earnings beat growth and margin expectations. But 2025 is shaping up to be a difficult year for the company. Here’s the full analysis:

Q4 Results:

- Net sales grew to $187.8bn (+10% / +$17.8bn YoY)

- Operating income rose to $21.2bn (+60% / +$8.0bn YoY)

- Advertising grew to $17.3bn (+18% / +$2.6bn YoY)

FY-2024 Results:

- Net sales reached $638bn (+11% / +$63.2bn YoY)

- Operating income rose to $68.6bn (+86% / +$31.9bn YoY)

- Advertising grew to $70.87bn (+51% / +$24.0bn YoY)

Q1 Guidance

- Net Sales to reach $151.0bn – $155.5bn (+5% to +9% YoY)

- Operating Income predicted to grow to $14bn – $18bn

Analysis

Despite a volatile trading environment and cautious customer sentiment, Amazon delivered a strong 2024 performance.

In Retail, Amazon has improved customer interfaces, refined its AdTech capabilities and launched its shopping assistant Rufus. All while pushing for faster same- and next-day delivery speeds.

AWS launched a range of AI tools and introduced its own AI platform ‘Bedrock’, which enables generative AI models to be built.

It’s clear that Amazon’s $8 bn partnership with AI development company Anthrophic enables the retail giant to automate every part of its business, generating huge profits for the company.

But 2025 is set to slow Amazon’s expansion, with three main headwinds threatening the company’s earnings potential:

1. Retail disruption and cost headwinds

The introduction of tariffs on China significantly impacts 1P and 3P selling partners. 1P Vendors will seek to pass on tariffs to Amazon per cost price increases, while 3P Sellers will need to pass on price increases to shoppers.

Considering that half of Amazon’s 10,000 largest 3P Sellers operate in China and most 1P manufacturer brands source their products from Asia’s largest market, we can expect sales headwinds to unfold as early as Q1-2025.

2. Diversification focus of selling partners

Amazon’s relentless focus on profitability has driven many brands to explore alternatives, seeking to reduce their reliance on the retailer. While recent tariffs may slow the expansion of Temu and Shein, brands will continue to seek alternatives to protect margins.

If Amazon doesn’t moderate its margin aggression with suppliers in 2025, it risks losing brands (and selection) from its marketplace.

3. Price wars with other retail giants

But it doesn’t end there: Amid an unfolding tariff war, rivalling retailers like Walmart will defend their market share by keeping prices low for customers. This adds pressure on Amazon to reinvest profits to match these low prices.

With Amazon’s strategy to expand its low ASP range, retail margins are likely to take a hit in 2025. And with limited sales growth from offline divisions, more Fresh and Go stores will likely shut their doors.