By Martin Heubel, Founder and Director of Consulterce, a strategy consultancy for B2C Household & CPG brands.

Most CFOs don’t understand the impact of financial disputes with Amazon, until it’s too late.

When the hidden cost centres have become too large to ignore, CFOs scramble to understand what has led to unpaid invoices, chargebacks, and provisions for receivables.

The reason is simple:

Most multinationals don’t have a central P&L

So hidden cost centres can build up for a while before getting noticed.

But there’s a simple framework to prevent this from happening.

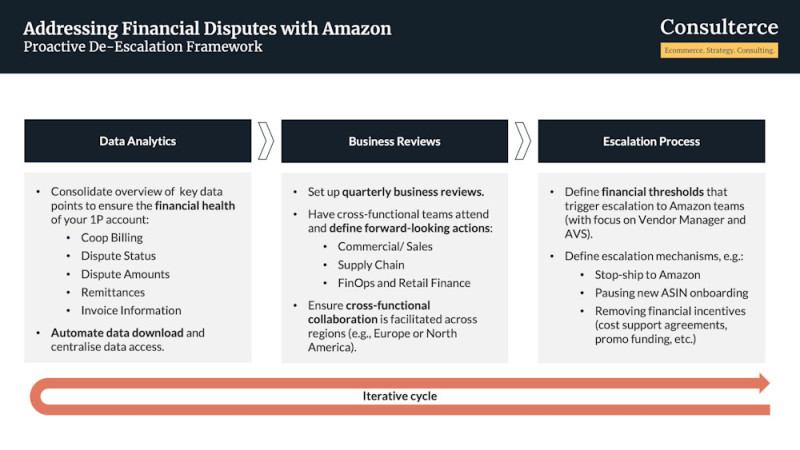

Introducing: The proactive financial de-escalation plan

It consists of three simple steps:

1. Measure the right data

Brands need to measure their financial performance consistently. While most brands already have sophisticated sales and margin reporting, they don’t track hidden cost centres consistently.

Gathering Coop Billing, Dispute, Remittance, and Invoice information in one place is a critical starting point. It lets your teams understand the status quo and identify root causes for financial misalignments.

2. Steup regular business reviews

Once the data collection is set up, ensure you get the right teams in one room – consistently. Financial misalignments are mainly root caused by operational process defects.

This means that your sales, supply chain, and finance teams must work hand-in-hand to isolate and address their root cause.

Having these cross-functional teams attend quarterly business reviews ensures greater visibility into the progress on operational issues that eat into your profit margins.

3. Define escalation mechanisms

The last step is to define your escalation mechanisms. Creating clear guardrails on when and how to escalate rejected disputes with Amazon ensures you don’t exceed set profitability thresholds.

For example, you may decide that whenever your shortages with Amazon exceed 1% of your annual turnover, your sales team escalates any pending disputes to your Vendor Manager.

This proactive approach ensures you don’t risk a stop-ship situation due to a derailed free cash flow impact on the Amazon account.

The bottom line?

By implementing these three steps, CFOs can significantly reduce the negative impact of financial disputes with Amazon.

It allows you to gain better visibility into hidden cost centres, address operational issues that contribute to financial misalignments, and establish effective mechanisms for resolving ageing disputes.

For further insight and support, contact Martin Heubel here