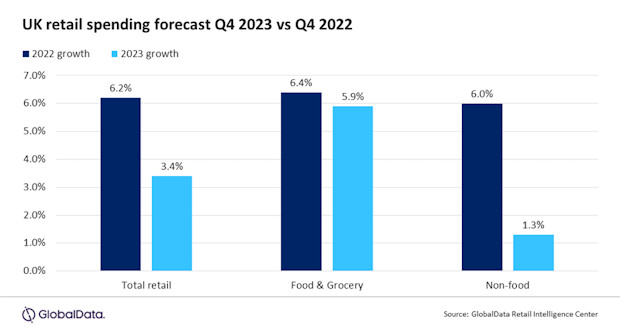

Shoppers in the UK are gearing up for Christmas spending despite facing a 9.3% increase in retail prices. While this rise is expected to drive up expenditure by 3.4%, this still falls short of last year’s increase and marks a second quarter of slowing growth in 2023, according to latest research by GlobalData.

The 3.4% increase will take retail spending to £109.7bn in the fourth quarter of 2023. While a significant rise, it is barely half the 6.2% achieved last year when people were able to celebrate properly for the first time in two years following the relaxation of Covid restrictions. It also marks a second quarter of slowing growth in 2023, with the increase down from a peak of 5.2% in Q2.

Nick Gladding, Lead Retail Analyst at GlobalData, commented: “This year’s growth in retail sales is driven by inflation, which GlobalData expects to reach 9.3% for the year as a whole. Sharply higher prices mean shoppers will spend less in real terms than last year, choosing either to trade down or trim the number of presents they buy. Last year, sales growth was supported by shoppers spending savings built up during the lockdown. But with those savings now depleted by cost-of-living increases and mortgage rate hikes, consumers are likely to shop more cautiously and more savvily.”

The continuing pressures on shoppers are evident from GlobalData’s latest (September) retail spending index, which is calculated by subtracting the number of households that say they will reduce their spending from those that will increase it. At -56.4, the index remains negative despite being slightly less so than a year ago, suggesting that retailers will need to inspire shoppers and emphasise value to encourage them to spend.

GlobalData expects food and grocery to grow faster than others this year, with shoppers spending £2.8bn (or 5.9%) more through the quarter than they did last year. This reflects the impact of price increases over the last 12 months, outweighing any recent month-on-month declines.

Gladding added: “This year GlobalData expects a record number of shoppers to shop at discounters as their keen pricing and strong seasonal offers attract high levels of footfall. Discounter expansion is forcing the competitor set to raise their game and emphasise quality and breadth of range. M&S has already taken steps in this direction with its new pre-Christmas ‘it’s never been just food’ campaign, while Tesco will make even more extensive use of Clubcard Prices this Christmas to offer enticing promotions to its loyalty scheme members, which should boost basket sizes.”

Of the non-food sectors, clothing and footwear is expected to grow the fastest despite a challenging comparative from last year when many shoppers splashed out on new outfits for the party season to make up for celebrations cancelled during the pandemic. The sector is proving resilient to cost of living cutbacks, with younger shoppers in particular enjoying being able to dress up and experiment again. A second trend is a continuing focus on building capsule wardrobes, small collections of clothes that can be put together in different ways, which often include premium pieces well suited to gifting.

The only other major sector forecast to experience increased sales year-on-year will be health and beauty, which is set to benefit from retailers stepping up their gifting and pampering offers. The inexpensive nature of many beauty items is likely to make them popular choices for shoppers on tight budgets.

Gladding concluded: “Sharply higher prices mean shoppers will spend less in real terms than last year, choosing either to trade down or trim the number of presents they buy. The dwindling savings, exacerbated by cost-of-living increases and mortgage rate hikes, are likely to shape consumers’ behaviour. As a result, retailers will need to inspire shoppers and emphasise the value they provide to encourage spending.”

NAM Implications:

- This looks like any growth will be at the expense of rivals, supplier or retail.

- Meaning it is time to identify New Norm relative competitive appeal…

- …and go for broke.