The recent slew of bad news around higher prices and product shortages appears to be impacting consumers’ enthusiasm for spending.

Official figures show retail sales volumes took a surprise dip last month to achieve their longest losing streak on record, whilst other data showed consumer confidence has slumped to levels last seen in February.

Sales fell by 0.2% in September, following a 0.6% drop in August, according to the Office for National Statistics (ONS). Economists had forecast a 0.5% increase last month despite consumers getting to grips with rising costs of many essentials as the economy feels the effects of the supply chain difficulties and higher commodity prices.

Non-food stores were hit hardest, with customers buying fewer household goods and furniture. Sales volumes also fell for chemists, toy stores and sports equipment stores.

However, clothing and department stores – among the hardest hit retailers during the pandemic – reported an increase in monthly sales volumes. Food shops also recorded a modest rise after falling last month.

The ONS said the overall decline meant that volumes had fallen each month since April, making it the longest period for shrinking sales since records began in 1996. However, volumes remain 4.2% above their pre-pandemic level.

The data shows that physical stores continue to struggle at the expense of those with an online presence. The proportion of online sales rose to 28.1% in September, from 27.9% the month before – substantially higher than pre-pandemic levels.

Helen Dickinson, Chief Executive of the British Retail Consortium (BRC), said that retailers would be “concerned” by the slump in sales in the run-up to the key Christmas trading period. “For the sake of the UK’s economic recovery, it is vital that retail sales bounce back as we near the festive season,” she said.

Dickinson highlighted labour shortages, alongside higher energy, commodity, and transport costs, were putting pressure on retailers to raise prices in the weeks ahead.

Meanwhile, Bethany Beckett, UK economist at Capital Economics, said the latest figures suggested the “economic recovery is fast running out of steam”.

She added: “Given the backdrop of continued shortages and rising Covid-19 infections, we suspect that retail sales growth will continue to be weak in the coming months.”

Separate data also released today shows that consumer confidence fell this month to hit its lowest level since February when the UK was in its last Covid lockdown.

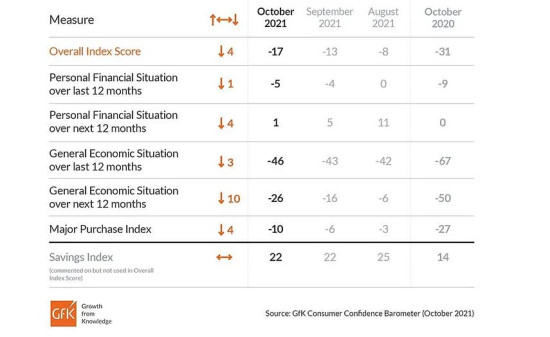

The GfK Consumer Confidence Index decreased four points to -17 in October, with all four measures down in comparison with last month’s announcement.

Joe Staton, client strategy director GfK, said: “After six months of robust recovery in the first half of 2021, UK consumer confidence has taken a turn for the worse with all vital signs weakening.”

He added: “Against a backdrop of cheerless domestic news – fuel and food shortages, surging inflation squeezing household budgets, the likelihood of interest rate rises impacting the cost of borrowing, and climbing Covid rates – it is not surprising that consumers are feeling down-in-the mouth about the chilly winter months ahead.

“Worryingly for British retailing in the run-up to Christmas, there’s a further decline in the intention to make major purchases. The financial mood of the nation has changed and consumers could do with some strong tonic to lift their spirits.”

NAM Implications:

- Hopefully not a surprise for the discerning NAM…

- Even super-savvy consumers are concerned on multiple fronts…

- With the only answer being to design an offer:

- That compares well with alternatives available…

- To build on trust and deliver more that it says on the tin…

- …always.