Despite inflation continuing to rise, latest data suggests consumers are continuing to spend and are more upbeat about the future.

Figures from the Office for National Statistics (ONS) show there was a larger-than-expected 1.2% rise in retail sales volumes in February compared to the previous month. However, when compared with the same month a year earlier, sales volumes fell by 3.5%.

On a month-on-month basis, non-food volumes rose by 2.4%, boosted by strong sales in discount department stores.

Meanwhile, food store volumes rose by 0.9% in February following a rise of 0.1% in January. The ONS said there was some evidence that the sector benefited from reduced spending in restaurants and on takeaways due to the cost-of-living crisis.

The figures were much better than economists had predicted as only a slight uptick was expected due to the pressure on consumers’ finances.

Darren Morgan, the director of economic statistics at ONS, said: “Retail grew sharply in February with sales returning to their pre-pandemic level.

“However, the broader picture remains more subdued, with retail sales showing little real growth, particularly over the last eighteen months with price rises hitting consumer spending power.”

The data was released against a backdrop of recent indications that the economy is slowly picking up and performing better than a slew of dire forecasts had predicted.

However, inflation remains an issue, with data this week showing the consumer prices index hit 10.4% in February – up from 10.1% the previous month. Economists had widely expected an easing in the rate, but salad shortages and an end to January pub drink discounts contributed to the rise.

Food and drink inflation struck a 45-year high and the Bank of England later acted through another interest rate rise.

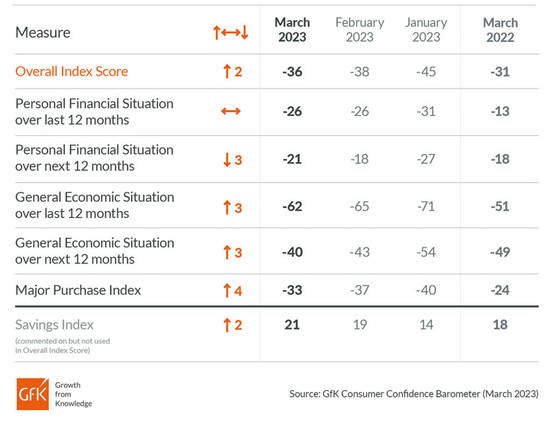

Despite these factors, consumers appear to be more upbeat. GfK’s consumer confidence index rose to -36 in March, with three measures up, one unchanged, and one down in comparison to last month’s announcement.

While still deep in negative territory, it was the highest level for 12 months and was boosted by improving sentiment around the economy and confidence in making major purchases.

Joe Staton, client strategy director at GfK, commented: “A small improvement in the overall index score this month masks continuing concerns among consumers about their personal financial situation.

“Forecasts that headline inflation will fall this year have proved premature, given Wednesday’s announcement of an unexpected increase. Wages are not keeping up with rising prices and the cost-of-living crisis remains a stark reality for most. The recent Budget will bring relief to some sections of the population, but for now, many people are simply looking to survive day-by-day. Just having enough money to live right and pay the bills remains the number one concern for consumers across the UK.”

NAM Implications:

- Consumer perception determines shopping behaviour.

- However, ‘Wages are not keeping up with rising prices and the cost-of-living crisis remains a stark reality for most’.

- This says it all…

- So pragmatic NAMs will factor down ‘green shoots’ until more obvious signs of improvement emerge.