Supermarket sales in the UK have begun to recover, according to the latest data by Nielsen, although the growth remains far short of that seen in summer 2018.

Nielsen’s figures show that overall UK supermarket sales rose by 1% in the last four weeks, in contrast to a 0.5% decline in July. However, this still compares poorly to the 4.2% uplift seen in grocery sales during the same period last year.

During the four-week period, Nielsen found that shoppers spent £85m more year-on-year on own label products, with volumes rising by 3%, while volumes of branded products declined by 2%. In own label, shoppers bought more frozen foods (+7%), canned and packaged grocery items (+6%), and bakery products (+5%), which Nielsen said can be attributed to increasing caution around spending as well as shifting promotional priorities.

During the period, Sainsbury’s experienced a +1.3% lift in sales, and was the only supermarket in the Big Four to attract new shoppers, helped by its accelerated efforts around targeted vouchering. Marks & Spencer also fared well, experiencing an uplift of +1.4% during the four weeks, helped by shoppers visiting more often and its new ‘Fresh Market Specials’ campaign.

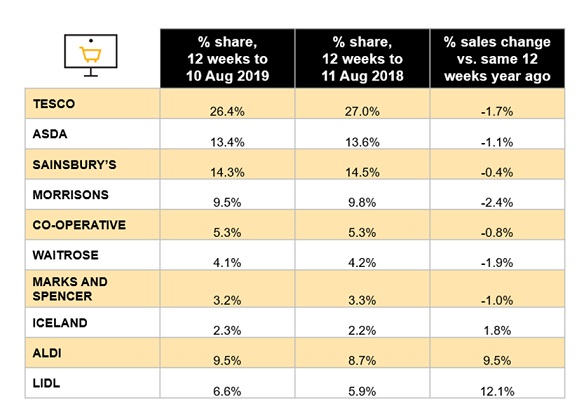

These uplifts were in stark contrast to the trend over the last 12 weeks, where discounters continued to show strong sales growth, with Lidl experiencing a +12.1% uplift, whilst Aldi rose by +9.5%. Whereas sales continued to decline at every other major supermarket, except Iceland.

Mike Watkins, Nielsen’s UK Head of Retailer and Business Insight, said: “We’re starting to see shopping behaviour return to normal with the increase in own label purchasing given their lower price points, whereas last year shoppers bought more branded products thanks to heavy promotions tied to the big event of summer 2018.”

Watkins concluded: “It is promising to see that the grocery market has started to recover from the low growth which has been a consistent theme since Easter. These trends have largely been obfuscated by the weather and current value growth is still not in line with inflation, which the latest Consumer Price Index pegged at 2.1%. As a whole, the big four supermarkets are still continuing to lose market share.”

NAM Implications:

- These results are indicators of increasing pressure on consumer purchases reflecting loss of confidence and increasing uncertainty re employment etc.

- i.e. increased own label, more frozen, canned and packaged grocery.

- Important for NAMs to compare their sales to individual mults to the mults’ Nielsen performances.

- …and hopefully build on any strengths.

- NB: note the discounter growth figures in terms of your real future?

- Fingers crossed re the ‘green shoots’ of a real recovery…